Optimizing Liquidity in an Uncertain Environment

-

bookmark

-

print

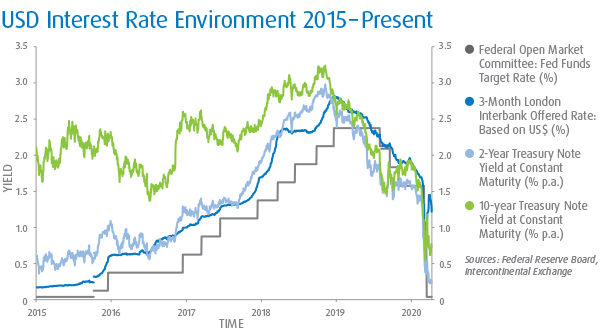

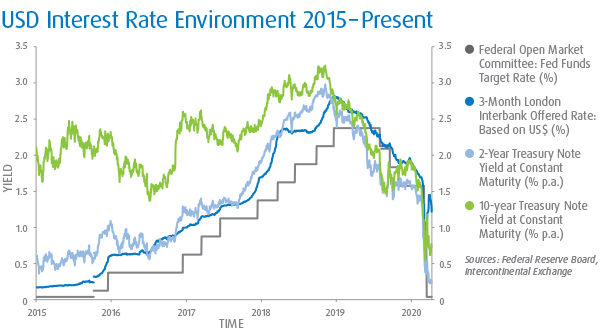

While COVID-19 has put pressure on businesses of all sizes in 2020, the Corporate Treasurer has been dealing with some level of uncertainty in the rate environment for some time. Starting in 2015 businesses witnessed a fairly steady rising interest rate environment, at least on overnight and short- term U.S. yields. And as interest rates increased, Corporate Treasurers, even those not being particularly mindful of optimizing liquidity, largely benefitted from yield increases on all types of cash; working capital, reserve and strategic. USD interest rates then plateaued, however, and due largely to global economic concerns and forecasted adverse effects to GDP from tariff wars, yields on USD started to decrease through the latter part of 2019, precipitated by three Federal Reserve rate cuts.

As the global economy continued to seek firmer footing, a global pandemic then rippled through the economy, leading to a dramatic reduction in yields from the world’s respective Central Banks. Monetary and fiscal emergency measures, not witnessed since the 2008 Great Recession, were implemented. At the early stages of COVID-19, a myriad of Corporate Treasurers rapidly transitioned from the pursuit of yield optimization to ensuring full safety of principal and working to create a “liquidity beachhead,” to navigate through what has become the most serious health and economic crises in modern history. And while Corporate Treasurers have had to quickly react to the rapidly changing economic environment, the way all organizations are working through COVID-19 and the uncertainty of when and how the “economy will fully re-open,” the approach to managing liquidity through this time fortunately-does not materially change.

Ensuring all liquidity is being optimized requires a commitment to accurately define the different buckets of cash via forecasting and subsequently working to find solutions that cover all types of cash from working capital to reserve. Let’s discuss how Corporate Treasurers should think about optimizing return on cash, even during this period of incredible uncertainty, paying particular attention to ensuring seamless operations for working capital cash and sufficient liquidity.

Sources: Federal Reserve Board, Intercontinental Exchange

1. Diversify

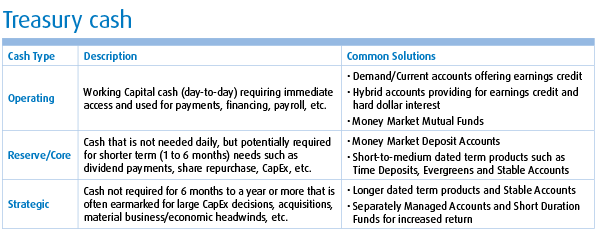

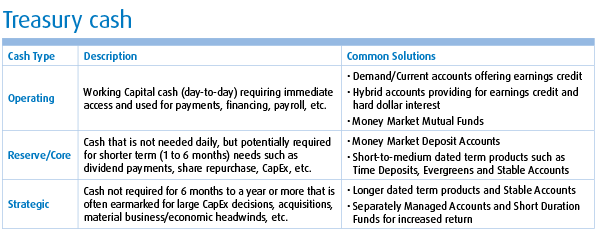

Treasury Cash – The Whole Is Greater Than the Sum of The Parts

In order for Corporate Treasurers to truly be able to optimize an organization’s cash, it is imperative to forecast as accurately as possible. Accurate forecasting helps avoid common pitfalls such as leaving too much buffer cash in a nominal return operating account or having to draw on an expensive credit line after erroneously locking up funds in a term product. Knowing how to differentiate the types of cash a Treasury holds via a disciplined cash flow analysis that accounts for things such as seasonality, known CapEx payments, dividend and share buy-back expectations, etc. is the first step in optimizing liquidity.

Once a Corporate Treasurer is confident there exists as much visibility over the entire picture as possible, an endeavor obviously made extremely more difficult in the current uncertain economic and health environment, attention can be turned toward finding the right liquidity solutions; solutions that match each type of cash, maximizing yield and ensuring that neither accessibility nor risk mitigation is sacrificed. For those instances where Treasurers are challenged to ascertain a firm grasp on cash flow and/or make a decision on exactly how much cash should be ‘on-hand’ to meet working capital needs, it makes sense in this environment to err on the side of more “buffer” cash in daily liquid solutions, going out only slightly along the curve for additional yield when confident and comfortable to do so.

2. Optimize working capital

Working Capital Cash – Running the Business Is Key, But Some Return Always Helps

The Corporate Treasurer’s main objective is always the seamless financial operation of the business. Ensuring all payments are made in a timely manner without suffering overdrafts and maintaining sufficient working capital cash when and where it is needed daily is obviously the foundation of a Treasury department. However, how we work has dramatically shifted with new things to consider like working remotely, geographically distant teams, and challenges with executing legal docs and gaining full visibility over F/X and other markets. These shifts are making the ability to seamlessly manage a Treasury Department extremely difficult, especially as it relates to avoiding operational errors and inefficiency, which are as important as they ever have been. And while reserve and strategic cash--which can be placed in longer term and sometimes more risk-tolerant solutions--can generate higher yield, the ability to generate return on operating cash should not be overlooked, even in this environment. In addition to disciplined forecasting, knowing the solutions that a Corporate Treasurer’s financial providers offer and what might be important to them is key to maximizing working capital cash. In this heightened regulatory environment that has persisted following the 2008 Great Recession, operational cash has become extremely important to banks as they need to meet certain regulatory ratios including, the Liquidity Coverage Ratio (LCR). The LCR assigns more ‘ratio’ value to banks for operational cash than other types, encouraging banks to source as much core banking business as possible, with corresponding deposits to fund its balance sheet.

Armed with the knowledge of what is important to your financial providers as well as what solutions are available, a Corporate Treasurer holds great potential for higher yield. For example, one way to ensure return is being maximized on working capital cash is to fully understand the value placed on operating business and determining whether further consolidating collections and payments to fewer providers, requiring more cash on account, can help mitigate potential rate reductions or simply engender higher yield in general. In addition, finding providers that offer solutions that maximize return on working capital cash, such as Hybrid ECR/DDA products that provide for hard dollar return on “operating buffer cash” will help ensure as much yield as possible is derived from cash needed daily.

3. Yield optimization

Reserve Cash – A Little Bit of Certainty Goes A Long Way on Yield

In terms of reserve cash, large variations in return and in many instances accessibility to cash exist, depending on factors such as the ability of a Corporate Treasurer to utilize products further along the curve, the amount of funds available to place and the Treasurer’s respective financial institution’s need to better fund loans. As a Corporate Treasurer differentiates reserve, often considered ‘excess’ cash, from working capital cash, it is this type of liquidity that starts to better enable the Treasurer to focus on further maximizing yield. Assuming principal preservation remains the guiding tenet for reserve cash, there are a multitude of solutions to consider and an approach to certain financial institution providers that will facilitate additional yield generation.

In looking to maximize return on reserve cash, the driving principle is to guarantee, as best as possible of course, stability of funds to your financial providers. Explicitly, this focus on stability can be achieved by placing funds in products that require some lock-up, whether it is in vehicles like longer dated time deposit products, commercial paper or repos. For those Treasurers that need to maintain as much liquidity as possible, utilizing solutions such as evergreen/call deposits (time deposits with no stated maturity that provide higher yield and return funds over a pre-defined period upon being “called”) can help strike a sound balance between accessibility of funds and higher yield.

Implicitly, even if a Corporate Treasurer requires reserve cash be available for immediate use, whether for a possible acquisition or via an investment policy limitation, communicating the ability to access those funds infrequently or creating a regular pattern of replenishing funds to a financial provider can have a material effect in returning higher yields.

One of the consequences of the material reduction in overnight rates from the Federal Reserve is that there is now a mostly upward sloping yield curve on USD rates. Coupled with a lack of liquidity in the market as the COVID-19 crisis deepened, rates on short-to-medium tenor time deposits (e.g., 1-month, 2-month, 3-month) became very attractive in relation to many overnight instruments. And while the lack of liquidity and market ‘dislocation’ has certainly eased somewhat, an upward sloping yield curve still represents an opportunity for increased return. The ability to capitalize on these yields, for those Corporate Treasurers harboring a level of confidence and comfort with locking up funds, can provide a meaningful boost in yield.

Strategic Cash – Multiple Variables to Consider

Optimizing strategic cash is often more disparate across organizations and includes more variables to consider. Depending upon investment policy guidelines and the risk-tolerance of an organization, solutions may be as straightforward as a money market deposit account or as complex as tax deferred investment strategies. For those Corporate Treasurers focused on solutions incurring no principal risk, the approach to strategic cash solutions will be an extension of the reserve cash approach, being even more mindful of the effects of a changing interest rate environment and messaging of stability of funds.

For those Corporate Treasurers empowered to seek higher yields with additional levels of risk, entering into actively managed solutions such as short duration funds and separately managed accounts can help generate even greater return. It is also important to consider how things such as F/X strategies may intersect with strategic cash and how available solutions like a dual currency deposit can generate increased return without altering how currency payments are made. For more complex solutions that incur principal risk, but can generate heightened returns, partnering with an asset manager that can run scenario analysis and ensure alignment of solutions to an investment policy is clearly essential.

4. Contingency planning

Times are Grim, but are they Negative?

In mid-March as schools closed, working remotely became the ‘new normal’ and statewide stay-at-home orders became part of everyone’s lexicon, the market witnessed a dramatic flight-to-quality that saw short-term T-bills temporarily trade negative. In light of near-zero interest rates from the Federal Reserve and a short-term Treasury-bill blip, many Corporate Treasurers were left wondering out loud if USD rates are headed toward negative territory as a monetary policy tool, similar to what has been witnessed on the EURO and major Nordic currencies over the past several years. While impossible to predict exactly what the Federal Reserve will due to combat the deleterious effects of COVID-19 to the U.S. and global economy, it appears very unlikely that Corporate Treasurers should expect to see negative yields on bank accounts or short-term deposit products such as Time Deposits. In addition to the negative rate ‘experiment’ in the Eurozone, that is still subject to much debate as to its level of success (or lack thereof), the Federal Reserve seems committed to near zero interest rates, not negative rates, resurrecting the Quantitative Easing program, and messaging to the government for additional fiscal policy support to the economy. In fact, Jerome Powell, Chairman of the Federal Reserve, has said during the earlier stages of the COVID-19 crisis that “we do not see negative policy rates as likely to be an appropriate policy response here in the United States,” and he does not seem to have wavered from that stance. Instead, Corporate Treasurers should expect low rates for the foreseeable future, especially in daily liquidity solutions, making it important to safely seek yield wherever available.

Conclusion

To the majority of Corporate Treasurers, ensuring a seamless management of treasury cash including, collections made on a regular basis and payments executed when desired and without incident is the foremost priority. This has never been as true as it is now, with remote workforces and heightened uncertainty due to COVID-19. However, being mindful of and seeking ways to create optimal liquidity solutions can be an important component of shareholder value and is imperative to Corporate Treasurers looking to maximize yield on treasury cash in any rate environment, even this one. Constantly focusing on, an even longer-term horizon, and improving forecasting while knowing how your financial providers value different types of cash and stability, in order to maximize return, is essential. In addition, staying keen to those institutions that are looking to fund growing loan portfolios can also provide a yield tailwind as they tend to be more creative with solutions and flexible on deposit product pricing and will work with Corporate Treasurers to find mutually agreeable solutions.

-

Minute Read

-

Listen

Stop

-

Text Bigger | Text Smaller

While COVID-19 has put pressure on businesses of all sizes in 2020, the Corporate Treasurer has been dealing with some level of uncertainty in the rate environment for some time. Starting in 2015 businesses witnessed a fairly steady rising interest rate environment, at least on overnight and short- term U.S. yields. And as interest rates increased, Corporate Treasurers, even those not being particularly mindful of optimizing liquidity, largely benefitted from yield increases on all types of cash; working capital, reserve and strategic. USD interest rates then plateaued, however, and due largely to global economic concerns and forecasted adverse effects to GDP from tariff wars, yields on USD started to decrease through the latter part of 2019, precipitated by three Federal Reserve rate cuts.

As the global economy continued to seek firmer footing, a global pandemic then rippled through the economy, leading to a dramatic reduction in yields from the world’s respective Central Banks. Monetary and fiscal emergency measures, not witnessed since the 2008 Great Recession, were implemented. At the early stages of COVID-19, a myriad of Corporate Treasurers rapidly transitioned from the pursuit of yield optimization to ensuring full safety of principal and working to create a “liquidity beachhead,” to navigate through what has become the most serious health and economic crises in modern history. And while Corporate Treasurers have had to quickly react to the rapidly changing economic environment, the way all organizations are working through COVID-19 and the uncertainty of when and how the “economy will fully re-open,” the approach to managing liquidity through this time fortunately-does not materially change.

Ensuring all liquidity is being optimized requires a commitment to accurately define the different buckets of cash via forecasting and subsequently working to find solutions that cover all types of cash from working capital to reserve. Let’s discuss how Corporate Treasurers should think about optimizing return on cash, even during this period of incredible uncertainty, paying particular attention to ensuring seamless operations for working capital cash and sufficient liquidity.

Sources: Federal Reserve Board, Intercontinental Exchange

1. Diversify

Treasury Cash – The Whole Is Greater Than the Sum of The Parts

In order for Corporate Treasurers to truly be able to optimize an organization’s cash, it is imperative to forecast as accurately as possible. Accurate forecasting helps avoid common pitfalls such as leaving too much buffer cash in a nominal return operating account or having to draw on an expensive credit line after erroneously locking up funds in a term product. Knowing how to differentiate the types of cash a Treasury holds via a disciplined cash flow analysis that accounts for things such as seasonality, known CapEx payments, dividend and share buy-back expectations, etc. is the first step in optimizing liquidity.

Once a Corporate Treasurer is confident there exists as much visibility over the entire picture as possible, an endeavor obviously made extremely more difficult in the current uncertain economic and health environment, attention can be turned toward finding the right liquidity solutions; solutions that match each type of cash, maximizing yield and ensuring that neither accessibility nor risk mitigation is sacrificed. For those instances where Treasurers are challenged to ascertain a firm grasp on cash flow and/or make a decision on exactly how much cash should be ‘on-hand’ to meet working capital needs, it makes sense in this environment to err on the side of more “buffer” cash in daily liquid solutions, going out only slightly along the curve for additional yield when confident and comfortable to do so.

2. Optimize working capital

Working Capital Cash – Running the Business Is Key, But Some Return Always Helps

The Corporate Treasurer’s main objective is always the seamless financial operation of the business. Ensuring all payments are made in a timely manner without suffering overdrafts and maintaining sufficient working capital cash when and where it is needed daily is obviously the foundation of a Treasury department. However, how we work has dramatically shifted with new things to consider like working remotely, geographically distant teams, and challenges with executing legal docs and gaining full visibility over F/X and other markets. These shifts are making the ability to seamlessly manage a Treasury Department extremely difficult, especially as it relates to avoiding operational errors and inefficiency, which are as important as they ever have been. And while reserve and strategic cash--which can be placed in longer term and sometimes more risk-tolerant solutions--can generate higher yield, the ability to generate return on operating cash should not be overlooked, even in this environment. In addition to disciplined forecasting, knowing the solutions that a Corporate Treasurer’s financial providers offer and what might be important to them is key to maximizing working capital cash. In this heightened regulatory environment that has persisted following the 2008 Great Recession, operational cash has become extremely important to banks as they need to meet certain regulatory ratios including, the Liquidity Coverage Ratio (LCR). The LCR assigns more ‘ratio’ value to banks for operational cash than other types, encouraging banks to source as much core banking business as possible, with corresponding deposits to fund its balance sheet.

Armed with the knowledge of what is important to your financial providers as well as what solutions are available, a Corporate Treasurer holds great potential for higher yield. For example, one way to ensure return is being maximized on working capital cash is to fully understand the value placed on operating business and determining whether further consolidating collections and payments to fewer providers, requiring more cash on account, can help mitigate potential rate reductions or simply engender higher yield in general. In addition, finding providers that offer solutions that maximize return on working capital cash, such as Hybrid ECR/DDA products that provide for hard dollar return on “operating buffer cash” will help ensure as much yield as possible is derived from cash needed daily.

3. Yield optimization

Reserve Cash – A Little Bit of Certainty Goes A Long Way on Yield

In terms of reserve cash, large variations in return and in many instances accessibility to cash exist, depending on factors such as the ability of a Corporate Treasurer to utilize products further along the curve, the amount of funds available to place and the Treasurer’s respective financial institution’s need to better fund loans. As a Corporate Treasurer differentiates reserve, often considered ‘excess’ cash, from working capital cash, it is this type of liquidity that starts to better enable the Treasurer to focus on further maximizing yield. Assuming principal preservation remains the guiding tenet for reserve cash, there are a multitude of solutions to consider and an approach to certain financial institution providers that will facilitate additional yield generation.

In looking to maximize return on reserve cash, the driving principle is to guarantee, as best as possible of course, stability of funds to your financial providers. Explicitly, this focus on stability can be achieved by placing funds in products that require some lock-up, whether it is in vehicles like longer dated time deposit products, commercial paper or repos. For those Treasurers that need to maintain as much liquidity as possible, utilizing solutions such as evergreen/call deposits (time deposits with no stated maturity that provide higher yield and return funds over a pre-defined period upon being “called”) can help strike a sound balance between accessibility of funds and higher yield.

Implicitly, even if a Corporate Treasurer requires reserve cash be available for immediate use, whether for a possible acquisition or via an investment policy limitation, communicating the ability to access those funds infrequently or creating a regular pattern of replenishing funds to a financial provider can have a material effect in returning higher yields.

One of the consequences of the material reduction in overnight rates from the Federal Reserve is that there is now a mostly upward sloping yield curve on USD rates. Coupled with a lack of liquidity in the market as the COVID-19 crisis deepened, rates on short-to-medium tenor time deposits (e.g., 1-month, 2-month, 3-month) became very attractive in relation to many overnight instruments. And while the lack of liquidity and market ‘dislocation’ has certainly eased somewhat, an upward sloping yield curve still represents an opportunity for increased return. The ability to capitalize on these yields, for those Corporate Treasurers harboring a level of confidence and comfort with locking up funds, can provide a meaningful boost in yield.

Strategic Cash – Multiple Variables to Consider

Optimizing strategic cash is often more disparate across organizations and includes more variables to consider. Depending upon investment policy guidelines and the risk-tolerance of an organization, solutions may be as straightforward as a money market deposit account or as complex as tax deferred investment strategies. For those Corporate Treasurers focused on solutions incurring no principal risk, the approach to strategic cash solutions will be an extension of the reserve cash approach, being even more mindful of the effects of a changing interest rate environment and messaging of stability of funds.

For those Corporate Treasurers empowered to seek higher yields with additional levels of risk, entering into actively managed solutions such as short duration funds and separately managed accounts can help generate even greater return. It is also important to consider how things such as F/X strategies may intersect with strategic cash and how available solutions like a dual currency deposit can generate increased return without altering how currency payments are made. For more complex solutions that incur principal risk, but can generate heightened returns, partnering with an asset manager that can run scenario analysis and ensure alignment of solutions to an investment policy is clearly essential.

4. Contingency planning

Times are Grim, but are they Negative?

In mid-March as schools closed, working remotely became the ‘new normal’ and statewide stay-at-home orders became part of everyone’s lexicon, the market witnessed a dramatic flight-to-quality that saw short-term T-bills temporarily trade negative. In light of near-zero interest rates from the Federal Reserve and a short-term Treasury-bill blip, many Corporate Treasurers were left wondering out loud if USD rates are headed toward negative territory as a monetary policy tool, similar to what has been witnessed on the EURO and major Nordic currencies over the past several years. While impossible to predict exactly what the Federal Reserve will due to combat the deleterious effects of COVID-19 to the U.S. and global economy, it appears very unlikely that Corporate Treasurers should expect to see negative yields on bank accounts or short-term deposit products such as Time Deposits. In addition to the negative rate ‘experiment’ in the Eurozone, that is still subject to much debate as to its level of success (or lack thereof), the Federal Reserve seems committed to near zero interest rates, not negative rates, resurrecting the Quantitative Easing program, and messaging to the government for additional fiscal policy support to the economy. In fact, Jerome Powell, Chairman of the Federal Reserve, has said during the earlier stages of the COVID-19 crisis that “we do not see negative policy rates as likely to be an appropriate policy response here in the United States,” and he does not seem to have wavered from that stance. Instead, Corporate Treasurers should expect low rates for the foreseeable future, especially in daily liquidity solutions, making it important to safely seek yield wherever available.

Conclusion

To the majority of Corporate Treasurers, ensuring a seamless management of treasury cash including, collections made on a regular basis and payments executed when desired and without incident is the foremost priority. This has never been as true as it is now, with remote workforces and heightened uncertainty due to COVID-19. However, being mindful of and seeking ways to create optimal liquidity solutions can be an important component of shareholder value and is imperative to Corporate Treasurers looking to maximize yield on treasury cash in any rate environment, even this one. Constantly focusing on, an even longer-term horizon, and improving forecasting while knowing how your financial providers value different types of cash and stability, in order to maximize return, is essential. In addition, staying keen to those institutions that are looking to fund growing loan portfolios can also provide a yield tailwind as they tend to be more creative with solutions and flexible on deposit product pricing and will work with Corporate Treasurers to find mutually agreeable solutions.

Road to Recovery 2020

PART 1

America’s Post-Pandemic Economic Prospects

Michael Gregory, CFA June 29, 2020

After dealing with the steepest, deepest, and fastest recession in history, there are clear indications that the U.S. economy has be…

PART 2

Eyeing an M&A Rebound

None July 13, 2020

As the Coronavirus pandemic spread globally and financial markets were impacted, we saw unprecedented disruption in M&A activity, and t…

PART 3

Food Supply Chain: Lessons Learned from COVID-19

Michael Johns July 27, 2020

The COVID-19 pandemic put significant stress on the food supply chain. From manufacturers to distributors to retailers, all links in the ch…

PART 5

COVID-19 Underscores the Evolution in Electronic Trading

August 24, 2020

There is no turnkey response to the COVID-19 pandemic that has left no facet of life unscathed, as nations, governments, industries and soc…

PART 6

Did COVID Actually Save Retail?

Simeon Siegel, CFA September 18, 2020

As retailers choose which stores to open, rather than close, on the heels of the COVID-19 outbreak, they face a once-in-a-lifetime opportun…

PART 7

Road to Recovery: Pandemic in Perspective

Dan Barclay, Brian Belski, None October 02, 2020

With North America six months into the fight against COVID-19, and as the world contemplates a potential second wave of the pandemic, some …

PART 8

Spectacular SPACs – The Unicorns Are Coming

Eric Benedict October 28, 2020

They’ve been called a flash in the pan by market pundits, critiqued for questionable returns, but the so-called Special Purpose Acqui…

You might also be interested in

NextGen Treasury: Protecting Your Organization from a Cybersecurity Attack

Op Ed: Businesses and Community Organizations Need to Come Together to Fight Poverty

Biggest Trends in Food and Ag, From ESG to Inflation to the Supply Chain

Cloud, Data and Zero-trust: Here’s Where VCs are Putting Their Cybersecurity Investments

BMO Announces $250,000 Donation to Organizations Supporting Global Emergency COVID-19 Relief Efforts

Canada Eyes Biggest Economic Rebound in Half a Century, Plots Equitable Recovery - Panel

Leading with Resiliency: Highlights from BMO’s Forum for Executive Women

Ian Bremmer in Conversation: The Pandemic and a Changing Geopolitical Landscape

COVID-19 Puts Spotlight on Strong Liquidity Management, Antifraud Practices

Canada's Six Biggest Banks Take Decisive Action To Help Customers Impacted by COVID-19