From Crisis to Resilience: The Rise of Corporate ESG

-

bookmark

-

print

The impact of COVID-19 and recent calls for racial equity around the world are propelling the nascent discipline of sustainable finance to new heights, as ESG practices become a must-have rather than a nice-to-have for corporations to attract investors' dollars.

Faced with a world where protecting against reputational risk is key to maintaining the loyalty of investors and consumers, public companies that hesitate to incorporate ESG principles and sustainability into their overall business strategy risk their ability to access capital markets easily. Market analysts are suggesting due diligence around ESG risk is also becoming critical in successful M&A and IPO deals in the post-COVID world. As investors take a magnifying glass to everything from environmental impact and employee health to cybersecurity and supply chains, that scrutiny is only going to intensify.

“We’re already seeing a number of private equity and investment funds, especially those with scale, paying more attention to climate change, diversity and other ESG concerns,” PWC said in its M&A outlook for 2020. The firm said ESG matters will likely become an area of even greater focus for investors in the year ahead.

That change is afoot is not lost on CEOs; when social unrest against systemic racism surged in recent weeks, we saw many corporate leaders declare their commitments to racial equity.

The rise of ESG in the collective conscience of investors is reflected in the data. Morningstar Direct, an investment analysis platform, found that more than $12.2 billion flowed into ESG-related retail funds in the first four months of 2020, more than double what went into these funds over the same time period last year, according to a report in The Wall Street Journal. Assuredly, demand for avenues into sustainable investing remains high.

Hard Lessons

As we’ve seen, credit deterioration has been severe since the pandemic began, impacting companies’ cost of capital as well as future capital expenditures. During the current recession, companies with stronger ESG profiles are expected to have greater access to financial markets and investors.

To be sure, analysts, proxy advisory firms, ESG analytics providers, NGOs and others that track corporate ESG practices, are paying more attention to the spectrum of Environmental, Social and Governance attributes, in areas ranging from executive compensation – CEOs who’ve received big bonuses during a period of mass layoffs have not been looked upon kindly – to supply chain risks, diversity and inclusion and much more.

Writing in the Harvard Law School Forum, Joshua Feltman and Emily Johnson, partners at Wachtell, Lipton, Rosen & Katz, a law firm that specializes in M&A and corporate financing, say that, over time, “We expect companies to find their cost of capital more directly tied to their ESG risk. All of the major credit ratings agencies have signed onto the Principles for Responsible Investment statement that ESG factors can weigh on default probability and consider such factors in their ratings.”

COVID-19 has proven to be a stress test for many businesses, forcing many companies to rethink the relevance of ESG considerations for their businesses. According to a Datamaran analysis of 1400 corporations, by March 31, 41% of U.S.-based companies and 37% of European business acknowledged in their financial reporting that COVID-19 was material to their business. While it may be early days yet, a recent Harvard study of more than 3,000 companies around the world found that more positive sentiment around a company’s response to COVID-19 is associated with less negative returns.

‘S’ and ‘G’ to weigh heaviest in the months ahead

While the Environmental aspects of ESG remain important, Social ‘S’ and Governance ‘G’ concerns have been pushed to the forefront during COVID-19 and amid the recent social unrest. The health and safety of employees, labour rights, and what companies do for their communities, are all coming under increasing investor scrutiny.

As the pandemic disrupted essential service industries, ranging from food to energy and medical equipment, we’ve seen growing inspection into how company supply chains work, which speaks to both the S and G and includes issues like responsible sourcing and fair operational practices and organizational governance.

“Buyers need to be aware of the pressure that their suppliers face in this moment of disruption – and of the consequences for their sustainability management and performance,” EcoVadis, a ratings platform that assesses a company’s sustainable procurement, said in a recent report that called for more agile supply chains and sustainability management systems that can help mitigate negative impacts during crises like the COVID-19 pandemic.

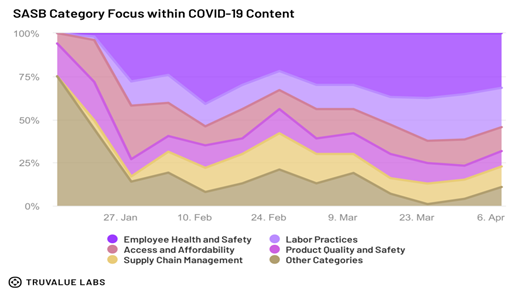

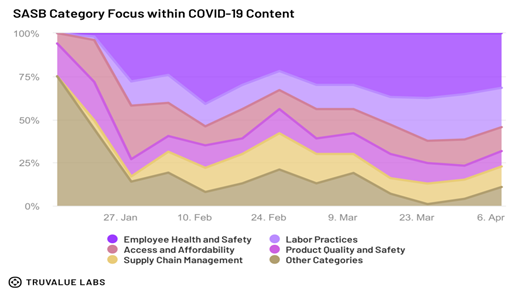

Truvalu Labs, an ESG analytics provider, said in a recent report that employee health and safety, labour practices, access and affordability, product quality and safety and supply chain management, are some of the material ESG factors exposed during the COVID-19 crisis.

When it comes to the G – good governance – evidence of strong capital management has long been a concern of investors, but as this crisis continues, investors will ask boards about how they plan to re-open and how they plan to respond to any further issues that arise.

IDB Invest has come up with a questionnaire for boards and investors regarding business continuity during COVID-19 that serves as a helpful guide for companies to demonstrate preparedness with action-oriented plans spearheaded by senior management.

What is clear is that, for many companies, incorporating ESG practices into their business will mean rethinking overall corporate strategy. For some, it will require meaningful efforts to diversify the makeup of their boards and executive teams, as well as forging partnerships to create products for the greater good, like Ford Motor Co.’s recent partnership with Thermo Fisher Scientific to produce hospital gowns and facemasks for frontline workers. Firms need to be adaptable to crisis while taking responsibility for past transgressions.

Stakeholder capitalism remains at the forefront in the pandemic world.

“We recognize the long-term viability of the companies in which we invest is inextricably tied to the welfare of their stakeholders, including their employees, suppliers, customers and the communities in which they operate,” more than 300 institutional investors and service providers, including BMO Global Asset Management, covering more than $9 trillion in AUM, said in a recent Investor Statement on Coronavirus Response. The online petition asked companies to consider five steps in helping limit the COVID-19 damage on the global economy: to provide paid leave, prioritize health and safety, maintain employment during COVID-19, keep supplier and customer relationships and practice financial prudence, which involves suspending share buybacks.

The ‘new normal’

As we emerge from this crisis, under the ‘new normal’, increasing acceptance of ESG considerations in business decision-making will drive sustainable finance on both the buy and sell sides. Going forward, it will be easier for companies with high ESG ratings to issue debt; we’re already seeing a number of organizations issue social bonds to help combat COVID-19. Businesses that do good by incorporating ESG best practices will have more successful IPOs and M&As and inclusion in SRI benchmark indices.

The ‘new normal’ will also see pension funds and asset owners focus on adding more ESG-related products, mutual funds and ETFs, while sell-side analysts will start incorporating more ESG analysis into their work.

It won’t be long before ESG factors are baked into every company’s mission and purpose, not just as the right thing to do, but because it’s also good for business. Some of it will be difficult but necessary work, especially when the world is watching.

-

Minute Read

-

Listen

Stop

-

Text Bigger | Text Smaller

The impact of COVID-19 and recent calls for racial equity around the world are propelling the nascent discipline of sustainable finance to new heights, as ESG practices become a must-have rather than a nice-to-have for corporations to attract investors' dollars.

Faced with a world where protecting against reputational risk is key to maintaining the loyalty of investors and consumers, public companies that hesitate to incorporate ESG principles and sustainability into their overall business strategy risk their ability to access capital markets easily. Market analysts are suggesting due diligence around ESG risk is also becoming critical in successful M&A and IPO deals in the post-COVID world. As investors take a magnifying glass to everything from environmental impact and employee health to cybersecurity and supply chains, that scrutiny is only going to intensify.

“We’re already seeing a number of private equity and investment funds, especially those with scale, paying more attention to climate change, diversity and other ESG concerns,” PWC said in its M&A outlook for 2020. The firm said ESG matters will likely become an area of even greater focus for investors in the year ahead.

That change is afoot is not lost on CEOs; when social unrest against systemic racism surged in recent weeks, we saw many corporate leaders declare their commitments to racial equity.

The rise of ESG in the collective conscience of investors is reflected in the data. Morningstar Direct, an investment analysis platform, found that more than $12.2 billion flowed into ESG-related retail funds in the first four months of 2020, more than double what went into these funds over the same time period last year, according to a report in The Wall Street Journal. Assuredly, demand for avenues into sustainable investing remains high.

Hard Lessons

As we’ve seen, credit deterioration has been severe since the pandemic began, impacting companies’ cost of capital as well as future capital expenditures. During the current recession, companies with stronger ESG profiles are expected to have greater access to financial markets and investors.

To be sure, analysts, proxy advisory firms, ESG analytics providers, NGOs and others that track corporate ESG practices, are paying more attention to the spectrum of Environmental, Social and Governance attributes, in areas ranging from executive compensation – CEOs who’ve received big bonuses during a period of mass layoffs have not been looked upon kindly – to supply chain risks, diversity and inclusion and much more.

Writing in the Harvard Law School Forum, Joshua Feltman and Emily Johnson, partners at Wachtell, Lipton, Rosen & Katz, a law firm that specializes in M&A and corporate financing, say that, over time, “We expect companies to find their cost of capital more directly tied to their ESG risk. All of the major credit ratings agencies have signed onto the Principles for Responsible Investment statement that ESG factors can weigh on default probability and consider such factors in their ratings.”

COVID-19 has proven to be a stress test for many businesses, forcing many companies to rethink the relevance of ESG considerations for their businesses. According to a Datamaran analysis of 1400 corporations, by March 31, 41% of U.S.-based companies and 37% of European business acknowledged in their financial reporting that COVID-19 was material to their business. While it may be early days yet, a recent Harvard study of more than 3,000 companies around the world found that more positive sentiment around a company’s response to COVID-19 is associated with less negative returns.

‘S’ and ‘G’ to weigh heaviest in the months ahead

While the Environmental aspects of ESG remain important, Social ‘S’ and Governance ‘G’ concerns have been pushed to the forefront during COVID-19 and amid the recent social unrest. The health and safety of employees, labour rights, and what companies do for their communities, are all coming under increasing investor scrutiny.

As the pandemic disrupted essential service industries, ranging from food to energy and medical equipment, we’ve seen growing inspection into how company supply chains work, which speaks to both the S and G and includes issues like responsible sourcing and fair operational practices and organizational governance.

“Buyers need to be aware of the pressure that their suppliers face in this moment of disruption – and of the consequences for their sustainability management and performance,” EcoVadis, a ratings platform that assesses a company’s sustainable procurement, said in a recent report that called for more agile supply chains and sustainability management systems that can help mitigate negative impacts during crises like the COVID-19 pandemic.

Truvalu Labs, an ESG analytics provider, said in a recent report that employee health and safety, labour practices, access and affordability, product quality and safety and supply chain management, are some of the material ESG factors exposed during the COVID-19 crisis.

When it comes to the G – good governance – evidence of strong capital management has long been a concern of investors, but as this crisis continues, investors will ask boards about how they plan to re-open and how they plan to respond to any further issues that arise.

IDB Invest has come up with a questionnaire for boards and investors regarding business continuity during COVID-19 that serves as a helpful guide for companies to demonstrate preparedness with action-oriented plans spearheaded by senior management.

What is clear is that, for many companies, incorporating ESG practices into their business will mean rethinking overall corporate strategy. For some, it will require meaningful efforts to diversify the makeup of their boards and executive teams, as well as forging partnerships to create products for the greater good, like Ford Motor Co.’s recent partnership with Thermo Fisher Scientific to produce hospital gowns and facemasks for frontline workers. Firms need to be adaptable to crisis while taking responsibility for past transgressions.

Stakeholder capitalism remains at the forefront in the pandemic world.

“We recognize the long-term viability of the companies in which we invest is inextricably tied to the welfare of their stakeholders, including their employees, suppliers, customers and the communities in which they operate,” more than 300 institutional investors and service providers, including BMO Global Asset Management, covering more than $9 trillion in AUM, said in a recent Investor Statement on Coronavirus Response. The online petition asked companies to consider five steps in helping limit the COVID-19 damage on the global economy: to provide paid leave, prioritize health and safety, maintain employment during COVID-19, keep supplier and customer relationships and practice financial prudence, which involves suspending share buybacks.

The ‘new normal’

As we emerge from this crisis, under the ‘new normal’, increasing acceptance of ESG considerations in business decision-making will drive sustainable finance on both the buy and sell sides. Going forward, it will be easier for companies with high ESG ratings to issue debt; we’re already seeing a number of organizations issue social bonds to help combat COVID-19. Businesses that do good by incorporating ESG best practices will have more successful IPOs and M&As and inclusion in SRI benchmark indices.

The ‘new normal’ will also see pension funds and asset owners focus on adding more ESG-related products, mutual funds and ETFs, while sell-side analysts will start incorporating more ESG analysis into their work.

It won’t be long before ESG factors are baked into every company’s mission and purpose, not just as the right thing to do, but because it’s also good for business. Some of it will be difficult but necessary work, especially when the world is watching.

You might also be interested in

A First in Western Canada: Avenue Living Leverages BMO's Retrofit Program to Add 179 New Rental Units in Downtown Edmonton

How NASA and IBM Are Using Geospatial Data and AI to Analyze Climate Risks

BMO Arranges Green Financing to Fund New Lawson Centre for Sustainability, Trinity College's Most Significant Build in a Century

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

Canada Has an Opportunity to Become a Global Leader in Carbon Dioxide Removal

More Companies Have Plans to Address Climate Change Based on Rising Business Importance: Survey Results

BMO Climate Institute Business Leaders Survey: Nearly Half of Business Leaders in the U.S. and Canada Believe Climate Change Has Already Affected Their Businesses, but Few Have a Strategy

How the Energy Sector Is Helping Canada Achieve Its Decarbonization Goals

Transforming the Global Food System to Benefit Investors and the Planet

Why Businesses Need to Accelerate Their Efforts to Fight Climate Change

Banco do Brasil and BMO Financial Group to Introduce First-of-its-Kind Program to Provide Sustainability-Linked Trade Loans Supporting Brazilian Exporters

BMO Donates $3 Million to GRID Alternatives to Provide Solar Energy Solutions for Low-Income Families

BMO Provides Innovative New Sustainability-Linked Deposit Product to Zurn Elkay Water Solutions

Quick Listen: Michael Torrance on Empowering Your Organization to Operationalize Sustainability

BMO and Bell Canada Execute Innovative Sustainability-Linked Derivative Tied to Ambitious GHG Emission Reduction Targets

BMO Named to UN-Convened Group Providing Guidance to Global Banks on Nature Target Setting

Driving Innovations In Tech To Strengthen Climate Resilience With Climate Engine’s Spatiafi, Built On Google Cloud

BMO Celebrates Earth Day with 3rd Annual Trees from Trades Day on its Global Trading Floors

BMO Donates $2 Million to the University of Saskatchewan to Accelerate Research Critical to the Future of Food

North America’s Critical Minerals Advantage: Deep Dive on Community Engagement

Rock Legends Reflect on Mining Hits and Misses: Global Metals, Mining & Critical Minerals Conference

The Most Valuable Commodity is Trust: ICMM to BMO Global Metals, Mining & Critical Minerals Conference

Exploring North America’s Critical Minerals Advantage: Global Metals, Mining & Critical Minerals Conference

BMO Experts at our 32nd Global Metals, Mining & Critical Minerals Conference

Evolving Mining for a Sustainable Energy Transition: ICMM CEO Rohitesh Dhawan in Conversation

Public Policy and the Energy Transition: Howard Learner in Conversation

Taskforce on Nature-Related Financial Disclosure (TNFD) – A Plan for Integrating Nature into Business

Takeaways from the BMO Climate Institute Small and Mid-Sized Businesses Climate Survey

BMO Ranked North America's Most Sustainable Bank by Corporate Knights for Fourth Consecutive Year

Is Green Financing for Nuclear the Next Frontier in the Energy Transition?

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

BMO Climate Institute Survey Shows Costs and Competing Priorities Slowing Climate Action for Small and Mid-Sized Businesses

Managing and Monetizing Your Transition to a Net Zero World with BMO and Radicle

BMO the Top Ranked Financial Institution on New Global Sustainability Benchmark Announced at COP 27

COP27 in Focus: Will Energy Security and Economic Uncertainty Impact the Climate Transition?

BMO to Invest in Innovative Carbon Offsets from CarbonCure to Permanently Store CO2

RoadMap Project: An Indigenous-led Paradigm Shift for Economic Reconciliation

A Canadian First: BMO and Concordia University Partner for a Sustainable Future with Innovative Sustainability-Linked Loan

Sustainability Strategy and Reporting for Small and Medium Sized Companies: A Discussion at the Conference of Montreal

Op Ed: Businesses and Community Organizations Need to Come Together to Fight Poverty

BMO to Acquire Calgary-based Radicle Group Inc., a Leader in Environmental Services

Investment Opportunities for a Net-Zero Economy: A Conversation at the Milken Institute Global Conference

How Hope, Grit, and a Hospital Network Saved Maverix Private Capital Founder John Ruffolo

Hydrogen’s Role in the Energy Transition: Matt Fairley in Conversation

Exploring the Physical and Transition Risks Facing Food and Agriculture

Key Takeaways on Ag, Food, Fertilizer & ESG from BMO’s Farm to Market Conference

Building an ESG Business Case in the Food Sector: The Food Institute

Forging Ahead in the Energy Transition: Darryl White to Global Reserve and Asset Managers

BMO and EDC Announce Collaboration to Introduce Sustainable Finance Solutions for Canadian Businesses

Retrofitting Canada's Building Sector: Efficiency Canada’s Corey Diamond in Conversation

The Role of Hydrogen in the Energy Transition: FuelCell Energy CEO Jason Few in Conversation

BMO proud to support first Government of Canada Green Bond transaction as joint-lead manager

Op Ed: Government Action Can Help Spur More Home Building To Address Canada’s Housing Shortage

Tackling Climate Change in Metals and Mining: ICMM CEO Rohitesh Dhawan in Conversation

BMO Launches Business Within Reach: BMO for Black Entrepreneurs and Commits $100 million in loans to Help Black-led Businesses Start up, Scale up, and Grow

The Post 2020 Biodiversity Framework – A Discussion with Basile Van Havre

BMO Announces Plan to Partner with Breakthrough Energy Catalyst to Accelerate Climate Innovation

BMO Financial Group Named North America's Most Sustainable Bank for Third Consecutive Year

Mitigating the Physical Impacts of Climate Change with Spatial Finance

BMO Helps Boralex Go Beyond Renewable Energy, with the Transition of its Credit Facility to a Sustainability-Linked Loan

A Global First: BMO Supports Bruce Power with World's First Nuclear Green Financing Framework

BMO ranked one of the most sustainable companies in the world according to Dow Jones Sustainability Indices

The Future of Remote Work and Diversity in the Asset Management Industry

North American Metals & Mining first: BMO helps Sandstorm Gold Royalties achieve ESG goals with Sustainability-Linked Loan

Education, Employment and Economic Empowerment: BMO Releases Wîcihitowin ᐑᒋᐦᐃᑐᐏᐣ- First Annual Indigenous Partnerships and Progress Report

BMO Announces $12 Billion Financing Commitment towards Affordable Housing in Canada

BMO supports Canada's bid to host the headquarters of the International Sustainability Standards Board

In support of Canada’s bid to host the headquarters of the International Sustainability Standards Board

BMO Named to Canada's Best 50 Corporate Citizens Ranking by Corporate Knights

Biggest Trends in Food and Ag, From ESG to Inflation to the Supply Chain

Cloud, Data and Zero-trust: Here’s Where VCs are Putting Their Cybersecurity Investments

BMO Announces $250,000 Donation to Organizations Supporting Global Emergency COVID-19 Relief Efforts

A North American First: BMO Helps Gibson Energy Fully Transition Credit Facility to a Sustainability-Linked Loan

Understanding Biodiversity Management: Best Practices and Innovation

Canada Eyes Biggest Economic Rebound in Half a Century, Plots Equitable Recovery - Panel

Leading with Resiliency: Highlights from BMO’s Forum for Executive Women

Ian Bremmer in Conversation: The Pandemic and a Changing Geopolitical Landscape

Episode 29: What 20 Years of ESG Engagement Can Teach Us About the Future

BMO Financial Group 2020 Sustainability Report and Public Accountability Statement Now Available Online

Episode 28: Bloomberg: Enhancing ESG Disclosure through Data-Driven Solutions

BMO Ranked Among Most Sustainable Companies on Dow Jones Sustainability Index - North America

BMO investing in a sustainable future with $1M donation to the Institute for Sustainable Finance

BMO Financial Group Reaches Key Milestone in Matching 100 Per Cent of Electricity Usage with Renewables

BMO Financial Group Recognized as One of the World's Most Sustainably Managed Companies in New Wall Street Journal Ranking

Episode 23: TC Transcontinental – A Market Leader in Sustainable Packaging

BMO Financial Group to Source 100 Per Cent of Electricity Usage From Renewables

COVID-19 Puts Spotlight on Strong Liquidity Management, Antifraud Practices

Canada's Six Biggest Banks Take Decisive Action To Help Customers Impacted by COVID-19

Episode 07: World Bank: Mobilizing Capital Markets for Sustainable Finance

Episode 06: Responsible Investing – Industry Trends and Best Practices from Canada