Financing Nature-Based Solutions Can Pay Dividends

-

bookmark

-

print

At this week’s 15th Conference of the Parties (COP15) to the United Nations Convention on Biological Diversity (CBD) held in Montreal, participants will seek to establish an action plan around protecting nature and stopping biodiversity loss around the world. A key call for action will be around narrowing the financing gap in investments in nature-based solutions, a critical tool for climate change mitigation and adaptation.

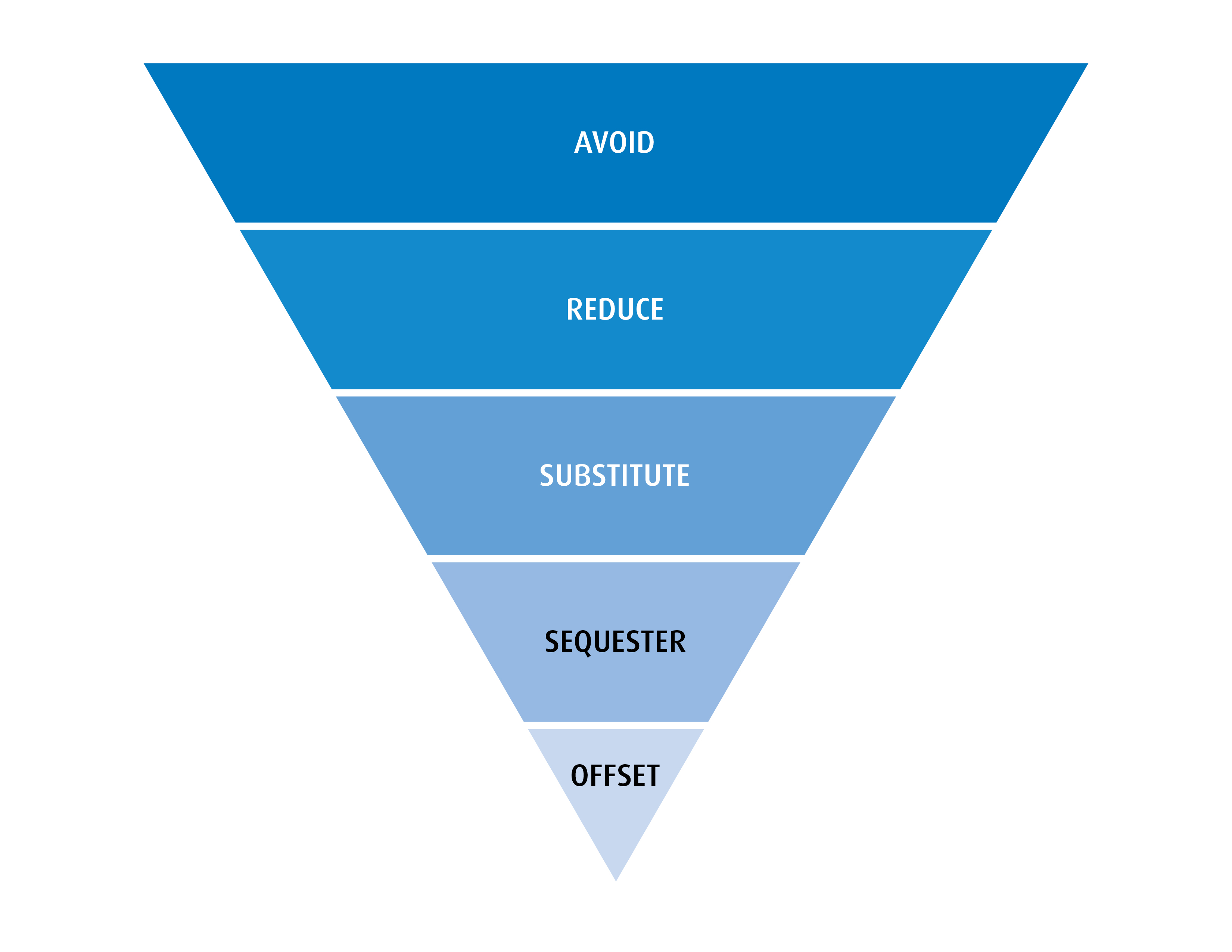

In recent years, greenhouse gas emissions management has quickly risen to the tops of agendas at many businesses, financial institutions and governments, under a shared understanding that urgent and collective action is needed to mitigate the increasing risks of changing climate. A silver bullet for curbing emissions does not exist, but there is an informal hierarchy of mitigation approaches that categorize and prioritize different alternatives for tackling the issue. The pyramid structure below visually depicts the importance of avoidance and reduction initiatives over substitution, sequestration and use of offsets for emissions that cannot be eliminated otherwise, because it recognizes that adjusting the business-as-usual activities before compensating for the gap is fundamental.

Figure 1. Carbon Mitigation Heirarchy

Among the different decarbonization levers currently available, one stands out for its ability to both prevent and remove emissions: nature-based solutions. The International Union for Conservation of Nature (IUCN) defines nature-based solutions as “actions to protect, sustainably manage, and restore natural or modified ecosystems that address societal challenges effectively and adaptively, simultaneously providing human well-being and biodiversity benefits.”[1] These ecosystem conservation, restoration and improved land management practices not only offer opportunities to avoid or absorb emissions, but also add buffers against the impacts of climate change facilitated by greenhouse gases. Climate action is mitigation in hand with adaptation; nature-based solutions can help with both.

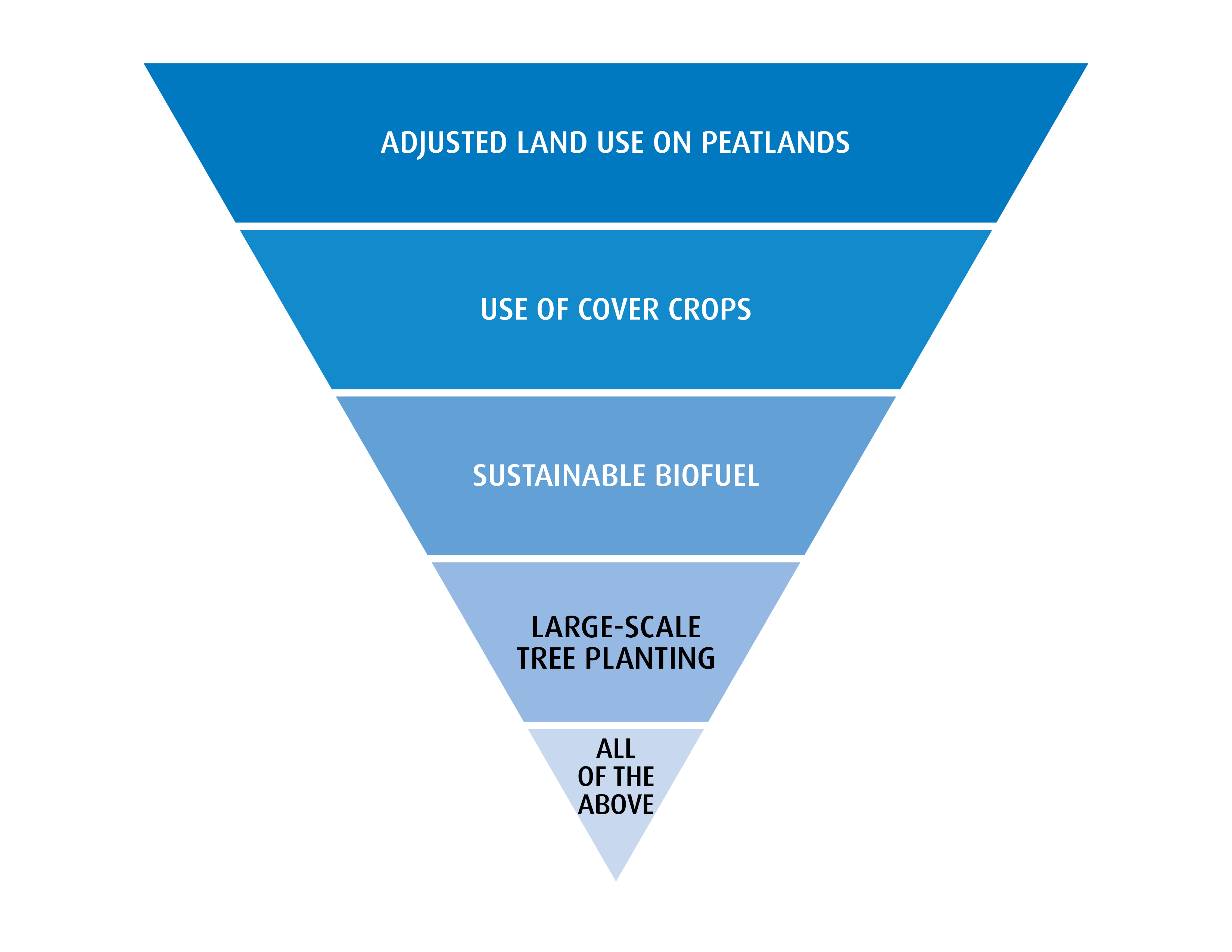

Figure 2. Examples of Nature-Based Solutions Across the Carbon Mitigation Hierarchy

The UN Climate Change Conference (COP 27) that took place last month hosted a “Biodiversity day” to highlight the interlinkage between biodiversity loss and climate change and to discuss nature conservation in the context of climate solutions. According to a study led by The Nature Conservancy, nature-based solutions could provide up to 37% of the emission reductions required by 2030 to achieve the Paris Climate Agreement goal of holding global warming to below 2°C.[2] However, scientists say the current trajectory we are on is a 10.6% increase in emissions by 2030 compared to 2010 levels.[3]

According to a May report by the United Nations Environment Program (UNEP), the world needs about US$8.1 trillion of investment in nature by 2050 – or an annual investment of US$536 billion – to tackle the interlinked climate, biodiversity, and land degradation crises.[4] Today, the voluntary carbon market provides one of the most critical infrastructures for directing capital into nature-based solutions. A growing number of companies have pledged to achieve net zero emissions, and many have also set accompanying nature-related targets (McKinsey reports approx. 85% of Fortune Global 500 companies have quantitative targets across multiple dimensions of nature.[5]) According to Ecosystem Marketplace, in 2021 nature-based carbon credits were double the price of renewable energy offsets in voluntary carbon markets, with many buyers willingly paying a premium for the co-benefits often observed in nature-based projects, such as community economic development and biodiversity conservation. Nature-based solutions now account for around 40% of retired (i.e., paid and accounted for) carbon credits in voluntary carbon markets, up from only 5% in 2010.[6]

Despite the uptick in demand and interest from businesses, investors and governments, nature-based solutions such as a form of carbon offsetting have invited critique, particularly around risks of greenwashing. For example, poorly designed carbon projects – such as planting monocultures of fast-growing commercial timber species – can undermine the ecosystem health overall and its long-term capacity to absorb carbon. Wildfires destroying forests whose conservation had already been paid for, and sequestration benefits accounted for, also raise questions around the legitimacy of voluntary carbon markets. These shortcomings around the integrity, standardization, traceability and additionality of voluntary carbon credits[7] will continue to pose important questions in the next couple years, but there are already efforts to create governance systems and enhance accountability, such as the Integrity Council for the Voluntary Carbon Market (ICVCM). Credible carbon offsets can deliver a practical vehicle for investing in conservation, restoration and land management projects across borders, and with the help of efforts to improve transparency and quality of these offsets, they have an indisputable impact on decarbonizing the economy globally. On the other side, any company’s or country’s reliance on these offsets without concrete actions to reduce emissions from existing operations and value chain – in other words, skipping to the bottom of the mitigation hierarchy – will be increasingly scrutinized.

Further innovative market-based mechanisms and initiatives exist today and are gaining traction, with some examples highlighted below:

-

A proposed pilot program of Environment and Climate Change Canada (ECCC) intended to generate government-backed biodiversity certificates in return for capital investments in conservation projects.

-

As far as back in 2002, Peru and the U.S. government arranged for a debt-for-nature swap, that relieved Peru of debt payments in exchange for the preservation of its tropical forests.[8]

-

In France, a recent decree under Article 29 of the French law on Energy and Climate requires French financial institutions to disclose how their financial activities depend on -as well as impact - biodiversity and climate.[9]

-

The Government of Indonesia published the Guideline on Blue Finance Instrument Development just last month, while a Japanese seafood company offered a ¥5 billion (US$35 million) blue bond whose proceeds will fund sustainable fisheries.

-

In 2020, the Science Based Targets Network – the same group of organizations behind the Science Based Targets initiative (SBTi) – published an initial guidance for businesses around setting science-based targets for nature.[10]

-

The Taskforce for Nature-related Financial Disclosures (TNFD) is refining its framework for companies to disclose their management of nature-related risks and opportunities. In October this year, 23 companies, with a total market value of US$1.3 trillion, announced their participation in a pilot to test and try the TNFD beta framework’s components and provide feedback.[11]

-

The UK’s Biodiversity Net Gain mandate in its 2021 Environment Bill that requires a minimum of 10% biodiversity gain in development and land management projects, also includes creating a statutory biodiversity credit scheme wherein developers can purchase credits to pay for habitat creation.[12]

-

Earlier this year, the World Bank issued a five-year US$150 million “Rhino Bond”, that includes a potential performance payment from the Global Environment Facility to help protect and increase black rhino populations in South Africa.[13]

-

The International Finance Corporation has developed a Biodiversity Finance Reference Guide building on the Green Bond Principles and the Green Loan Principles, to help identify potential investment projects and activities that advance natural resources protection and management.[14]

It is indisputable that nature is a key stakeholder in our collective transition to low-carbon, sustainable ways of doing business and living life. Innovative financing for nature-based solutions can accelerate the capital flow needed to meet global decarbonization goals as well as to abate climate risk mitigation costs.

At BMO we provide tailored financing solutions aligned with various sustainability objectives, including nature-related goals and projects. Last week we also announced the completion of the acquisition of Radicle Group Inc., a Calgary-based leader in sustainability advisory services and carbon credit development, as part of our continued commitment to be our clients’ lead partner in the transition to a net-zero world. To learn more about opportunities in leveraging nature-based solutions as part of a climate and decarbonization strategy, please reach out to our Sustainable Finance team at Sustainable.Finance@bmo.com.

[1] https://www.iucn.org/theme/nature-based-solutions/resources/iucn-global-standard-nbs

[2] https://www.nature.org/en-us/what-we-do/our-insights/perspectives/natural-climate-solutions/#:~:text=Research%20led%20by%20The%20Nature,30%25%20more%20than%20previously%20estimated

[3] https://unfccc.int/news/climate-plans-remain-insufficient-more-ambitious-action-needed-now

[4] https://www.unep.org/news-and-stories/press-release/world-needs-usd-81-trillion-investment-nature-2050-tackle-triple

[5] https://www.mckinsey.com/capabilities/sustainability/our-insights/where-the-worlds-largest-companies-stand-on-nature

[6] https://www.mckinsey.com/capabilities/sustainability/our-insights/why-investing-in-nature-is-key-to-climate-mitigation

[7] A voluntary carbon credit is a tradable permit generated from avoidance, reduction or removal of carbon emissions

[8] https://home.treasury.gov/news/press-releases/po3202#:~:text=The%20debt%2Dfor%2Dnature%20swap,preservation%20of%20its%20tropical%20forests

[9] https://tnfd.global/news/frances-article-29-biodiversity-disclosure-requirements-sign-of-whats-to-come/#:~:text=Under%20Article%2029%2C%20French%20financial,alignment%20with%20international%20biodiversity%20goals

[10] https://www2.deloitte.com/content/dam/Deloitte/fr/Documents/risk/Science-Based-Targets-for-Nature-Initial-Guidance-for-Business.pdf

[11] https://www.wbcsd.org/Overview/News-Insights/General/News/TNFD-pilot-program

[12] https://www.local.gov.uk/pas/topics/environment/biodiversity-net-gain-local-authorities/biodiversity-net-gain-faqs

[13] https://www.worldbank.org/en/news/press-release/2022/03/23/wildlife-conservation-bond-boosts-south-africa-s-efforts-to-protect-black-rhinos-and-support-local-communities

[14] https://www.ifc.org/wps/wcm/connect/74307fa1-4e33-42f1-b7e4-5f0b2f240f97/IFC+Biodiversity+Finance+Reference+Guide+Nov+2022+-+with+branding.pdf?MOD=AJPERES&CVID=oho1cOb

Financing Nature-Based Solutions Can Pay Dividends

Head, Sustainable Finance, Products and Strategy

John Uhren is Managing Director and Head, Sustainable Finance, Products and Strategy, at BMO. He leads product development and strategic initiatives across the ente…

John Uhren is Managing Director and Head, Sustainable Finance, Products and Strategy, at BMO. He leads product development and strategic initiatives across the ente…

VIEW FULL PROFILE-

Minute Read

-

Listen

Stop

-

Text Bigger | Text Smaller

At this week’s 15th Conference of the Parties (COP15) to the United Nations Convention on Biological Diversity (CBD) held in Montreal, participants will seek to establish an action plan around protecting nature and stopping biodiversity loss around the world. A key call for action will be around narrowing the financing gap in investments in nature-based solutions, a critical tool for climate change mitigation and adaptation.

In recent years, greenhouse gas emissions management has quickly risen to the tops of agendas at many businesses, financial institutions and governments, under a shared understanding that urgent and collective action is needed to mitigate the increasing risks of changing climate. A silver bullet for curbing emissions does not exist, but there is an informal hierarchy of mitigation approaches that categorize and prioritize different alternatives for tackling the issue. The pyramid structure below visually depicts the importance of avoidance and reduction initiatives over substitution, sequestration and use of offsets for emissions that cannot be eliminated otherwise, because it recognizes that adjusting the business-as-usual activities before compensating for the gap is fundamental.

Figure 1. Carbon Mitigation Heirarchy

Among the different decarbonization levers currently available, one stands out for its ability to both prevent and remove emissions: nature-based solutions. The International Union for Conservation of Nature (IUCN) defines nature-based solutions as “actions to protect, sustainably manage, and restore natural or modified ecosystems that address societal challenges effectively and adaptively, simultaneously providing human well-being and biodiversity benefits.”[1] These ecosystem conservation, restoration and improved land management practices not only offer opportunities to avoid or absorb emissions, but also add buffers against the impacts of climate change facilitated by greenhouse gases. Climate action is mitigation in hand with adaptation; nature-based solutions can help with both.

Figure 2. Examples of Nature-Based Solutions Across the Carbon Mitigation Hierarchy

The UN Climate Change Conference (COP 27) that took place last month hosted a “Biodiversity day” to highlight the interlinkage between biodiversity loss and climate change and to discuss nature conservation in the context of climate solutions. According to a study led by The Nature Conservancy, nature-based solutions could provide up to 37% of the emission reductions required by 2030 to achieve the Paris Climate Agreement goal of holding global warming to below 2°C.[2] However, scientists say the current trajectory we are on is a 10.6% increase in emissions by 2030 compared to 2010 levels.[3]

According to a May report by the United Nations Environment Program (UNEP), the world needs about US$8.1 trillion of investment in nature by 2050 – or an annual investment of US$536 billion – to tackle the interlinked climate, biodiversity, and land degradation crises.[4] Today, the voluntary carbon market provides one of the most critical infrastructures for directing capital into nature-based solutions. A growing number of companies have pledged to achieve net zero emissions, and many have also set accompanying nature-related targets (McKinsey reports approx. 85% of Fortune Global 500 companies have quantitative targets across multiple dimensions of nature.[5]) According to Ecosystem Marketplace, in 2021 nature-based carbon credits were double the price of renewable energy offsets in voluntary carbon markets, with many buyers willingly paying a premium for the co-benefits often observed in nature-based projects, such as community economic development and biodiversity conservation. Nature-based solutions now account for around 40% of retired (i.e., paid and accounted for) carbon credits in voluntary carbon markets, up from only 5% in 2010.[6]

Despite the uptick in demand and interest from businesses, investors and governments, nature-based solutions such as a form of carbon offsetting have invited critique, particularly around risks of greenwashing. For example, poorly designed carbon projects – such as planting monocultures of fast-growing commercial timber species – can undermine the ecosystem health overall and its long-term capacity to absorb carbon. Wildfires destroying forests whose conservation had already been paid for, and sequestration benefits accounted for, also raise questions around the legitimacy of voluntary carbon markets. These shortcomings around the integrity, standardization, traceability and additionality of voluntary carbon credits[7] will continue to pose important questions in the next couple years, but there are already efforts to create governance systems and enhance accountability, such as the Integrity Council for the Voluntary Carbon Market (ICVCM). Credible carbon offsets can deliver a practical vehicle for investing in conservation, restoration and land management projects across borders, and with the help of efforts to improve transparency and quality of these offsets, they have an indisputable impact on decarbonizing the economy globally. On the other side, any company’s or country’s reliance on these offsets without concrete actions to reduce emissions from existing operations and value chain – in other words, skipping to the bottom of the mitigation hierarchy – will be increasingly scrutinized.

Further innovative market-based mechanisms and initiatives exist today and are gaining traction, with some examples highlighted below:

-

A proposed pilot program of Environment and Climate Change Canada (ECCC) intended to generate government-backed biodiversity certificates in return for capital investments in conservation projects.

-

As far as back in 2002, Peru and the U.S. government arranged for a debt-for-nature swap, that relieved Peru of debt payments in exchange for the preservation of its tropical forests.[8]

-

In France, a recent decree under Article 29 of the French law on Energy and Climate requires French financial institutions to disclose how their financial activities depend on -as well as impact - biodiversity and climate.[9]

-

The Government of Indonesia published the Guideline on Blue Finance Instrument Development just last month, while a Japanese seafood company offered a ¥5 billion (US$35 million) blue bond whose proceeds will fund sustainable fisheries.

-

In 2020, the Science Based Targets Network – the same group of organizations behind the Science Based Targets initiative (SBTi) – published an initial guidance for businesses around setting science-based targets for nature.[10]

-

The Taskforce for Nature-related Financial Disclosures (TNFD) is refining its framework for companies to disclose their management of nature-related risks and opportunities. In October this year, 23 companies, with a total market value of US$1.3 trillion, announced their participation in a pilot to test and try the TNFD beta framework’s components and provide feedback.[11]

-

The UK’s Biodiversity Net Gain mandate in its 2021 Environment Bill that requires a minimum of 10% biodiversity gain in development and land management projects, also includes creating a statutory biodiversity credit scheme wherein developers can purchase credits to pay for habitat creation.[12]

-

Earlier this year, the World Bank issued a five-year US$150 million “Rhino Bond”, that includes a potential performance payment from the Global Environment Facility to help protect and increase black rhino populations in South Africa.[13]

-

The International Finance Corporation has developed a Biodiversity Finance Reference Guide building on the Green Bond Principles and the Green Loan Principles, to help identify potential investment projects and activities that advance natural resources protection and management.[14]

It is indisputable that nature is a key stakeholder in our collective transition to low-carbon, sustainable ways of doing business and living life. Innovative financing for nature-based solutions can accelerate the capital flow needed to meet global decarbonization goals as well as to abate climate risk mitigation costs.

At BMO we provide tailored financing solutions aligned with various sustainability objectives, including nature-related goals and projects. Last week we also announced the completion of the acquisition of Radicle Group Inc., a Calgary-based leader in sustainability advisory services and carbon credit development, as part of our continued commitment to be our clients’ lead partner in the transition to a net-zero world. To learn more about opportunities in leveraging nature-based solutions as part of a climate and decarbonization strategy, please reach out to our Sustainable Finance team at Sustainable.Finance@bmo.com.

[1] https://www.iucn.org/theme/nature-based-solutions/resources/iucn-global-standard-nbs

[2] https://www.nature.org/en-us/what-we-do/our-insights/perspectives/natural-climate-solutions/#:~:text=Research%20led%20by%20The%20Nature,30%25%20more%20than%20previously%20estimated

[3] https://unfccc.int/news/climate-plans-remain-insufficient-more-ambitious-action-needed-now

[4] https://www.unep.org/news-and-stories/press-release/world-needs-usd-81-trillion-investment-nature-2050-tackle-triple

[5] https://www.mckinsey.com/capabilities/sustainability/our-insights/where-the-worlds-largest-companies-stand-on-nature

[6] https://www.mckinsey.com/capabilities/sustainability/our-insights/why-investing-in-nature-is-key-to-climate-mitigation

[7] A voluntary carbon credit is a tradable permit generated from avoidance, reduction or removal of carbon emissions

[8] https://home.treasury.gov/news/press-releases/po3202#:~:text=The%20debt%2Dfor%2Dnature%20swap,preservation%20of%20its%20tropical%20forests

[9] https://tnfd.global/news/frances-article-29-biodiversity-disclosure-requirements-sign-of-whats-to-come/#:~:text=Under%20Article%2029%2C%20French%20financial,alignment%20with%20international%20biodiversity%20goals

[10] https://www2.deloitte.com/content/dam/Deloitte/fr/Documents/risk/Science-Based-Targets-for-Nature-Initial-Guidance-for-Business.pdf

[11] https://www.wbcsd.org/Overview/News-Insights/General/News/TNFD-pilot-program

[12] https://www.local.gov.uk/pas/topics/environment/biodiversity-net-gain-local-authorities/biodiversity-net-gain-faqs

[13] https://www.worldbank.org/en/news/press-release/2022/03/23/wildlife-conservation-bond-boosts-south-africa-s-efforts-to-protect-black-rhinos-and-support-local-communities

[14] https://www.ifc.org/wps/wcm/connect/74307fa1-4e33-42f1-b7e4-5f0b2f240f97/IFC+Biodiversity+Finance+Reference+Guide+Nov+2022+-+with+branding.pdf?MOD=AJPERES&CVID=oho1cOb

You might also be interested in

A Buyer’s Guide to Corporate Offsetting and Navigating the Voluntary Carbon Market

Why Sustainability Is Good Business: Key Takeaways from IEFA Toronto 2024

Building for Tomorrow: Real Estate, Construction, and Sustainability

A First in Western Canada: Avenue Living Leverages BMO's Retrofit Program to Add 179 New Rental Units in Downtown Edmonton

How NASA and IBM Are Using Geospatial Data and AI to Analyze Climate Risks

BMO Arranges Green Financing to Fund New Lawson Centre for Sustainability, Trinity College's Most Significant Build in a Century

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

Canada Has an Opportunity to Become a Global Leader in Carbon Dioxide Removal

More Companies Have Plans to Address Climate Change Based on Rising Business Importance: Survey Results

BMO Climate Institute Business Leaders Survey: Nearly Half of Business Leaders in the U.S. and Canada Believe Climate Change Has Already Affected Their Businesses, but Few Have a Strategy

How the Energy Sector Is Helping Canada Achieve Its Decarbonization Goals

Why Businesses Need to Accelerate Their Efforts to Fight Climate Change

Transforming the Global Food System to Benefit Investors and the Planet

Banco do Brasil and BMO Financial Group to Introduce First-of-its-Kind Program to Provide Sustainability-Linked Trade Loans Supporting Brazilian Exporters

BMO Donates $3 Million to GRID Alternatives to Provide Solar Energy Solutions for Low-Income Families

BMO Provides Innovative New Sustainability-Linked Deposit Product to Zurn Elkay Water Solutions

Quick Listen: Michael Torrance on Empowering Your Organization to Operationalize Sustainability

BMO and Bell Canada Execute Innovative Sustainability-Linked Derivative Tied to Ambitious GHG Emission Reduction Targets

BMO Named to UN-Convened Group Providing Guidance to Global Banks on Nature Target Setting

Driving Innovations In Tech To Strengthen Climate Resilience With Climate Engine’s Spatiafi, Built On Google Cloud

BMO Celebrates Earth Day with 3rd Annual Trees from Trades Day on its Global Trading Floors

BMO Donates $2 Million to the University of Saskatchewan to Accelerate Research Critical to the Future of Food

North America’s Critical Minerals Advantage: Deep Dive on Community Engagement

The Most Valuable Commodity is Trust: ICMM to BMO Global Metals, Mining & Critical Minerals Conference

Rock Legends Reflect on Mining Hits and Misses: Global Metals, Mining & Critical Minerals Conference

Exploring North America’s Critical Minerals Advantage: Global Metals, Mining & Critical Minerals Conference

BMO Experts at our 32nd Global Metals, Mining & Critical Minerals Conference

Evolving Mining for a Sustainable Energy Transition: ICMM CEO Rohitesh Dhawan in Conversation

Public Policy and the Energy Transition: Howard Learner in Conversation

Taskforce on Nature-Related Financial Disclosure (TNFD) – A Plan for Integrating Nature into Business

Takeaways from the BMO Climate Institute Small and Mid-Sized Businesses Climate Survey

BMO Ranked North America's Most Sustainable Bank by Corporate Knights for Fourth Consecutive Year

Is Green Financing for Nuclear the Next Frontier in the Energy Transition?

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

BMO Climate Institute Survey Shows Costs and Competing Priorities Slowing Climate Action for Small and Mid-Sized Businesses

Managing and Monetizing Your Transition to a Net Zero World with BMO and Radicle

BMO the Top Ranked Financial Institution on New Global Sustainability Benchmark Announced at COP 27

COP27 in Focus: Will Energy Security and Economic Uncertainty Impact the Climate Transition?

BMO to Invest in Innovative Carbon Offsets from CarbonCure to Permanently Store CO2

RoadMap Project: An Indigenous-led Paradigm Shift for Economic Reconciliation

A Canadian First: BMO and Concordia University Partner for a Sustainable Future with Innovative Sustainability-Linked Loan

Sustainability Strategy and Reporting for Small and Medium Sized Companies: A Discussion at the Conference of Montreal

BMO to Acquire Calgary-based Radicle Group Inc., a Leader in Environmental Services

Investment Opportunities for a Net-Zero Economy: A Conversation at the Milken Institute Global Conference

How Hope, Grit, and a Hospital Network Saved Maverix Private Capital Founder John Ruffolo

Hydrogen’s Role in the Energy Transition: Matt Fairley in Conversation

Key Takeaways on Ag, Food, Fertilizer & ESG from BMO’s Farm to Market Conference

Exploring the Physical and Transition Risks Facing Food and Agriculture

Building an ESG Business Case in the Food Sector: The Food Institute

BMO and EDC Announce Collaboration to Introduce Sustainable Finance Solutions for Canadian Businesses

Retrofitting Canada's Building Sector: Efficiency Canada’s Corey Diamond in Conversation

The Role of Hydrogen in the Energy Transition: FuelCell Energy CEO Jason Few in Conversation

BMO proud to support first Government of Canada Green Bond transaction as joint-lead manager

Tackling Climate Change in Metals and Mining: ICMM CEO Rohitesh Dhawan in Conversation

Op Ed: Government Action Can Help Spur More Home Building To Address Canada’s Housing Shortage

BMO Launches Business Within Reach: BMO for Black Entrepreneurs and Commits $100 million in loans to Help Black-led Businesses Start up, Scale up, and Grow

The Post 2020 Biodiversity Framework – A Discussion with Basile Van Havre

BMO Announces Plan to Partner with Breakthrough Energy Catalyst to Accelerate Climate Innovation

BMO Financial Group Named North America's Most Sustainable Bank for Third Consecutive Year

Mitigating the Physical Impacts of Climate Change with Spatial Finance

BMO Helps Boralex Go Beyond Renewable Energy, with the Transition of its Credit Facility to a Sustainability-Linked Loan

A Global First: BMO Supports Bruce Power with World's First Nuclear Green Financing Framework

BMO ranked one of the most sustainable companies in the world according to Dow Jones Sustainability Indices

The Future of Remote Work and Diversity in the Asset Management Industry

North American Metals & Mining first: BMO helps Sandstorm Gold Royalties achieve ESG goals with Sustainability-Linked Loan

Education, Employment and Economic Empowerment: BMO Releases Wîcihitowin ᐑᒋᐦᐃᑐᐏᐣ- First Annual Indigenous Partnerships and Progress Report

BMO Announces $12 Billion Financing Commitment towards Affordable Housing in Canada

BMO supports Canada's bid to host the headquarters of the International Sustainability Standards Board

In support of Canada’s bid to host the headquarters of the International Sustainability Standards Board

BMO Named to Canada's Best 50 Corporate Citizens Ranking by Corporate Knights

A North American First: BMO Helps Gibson Energy Fully Transition Credit Facility to a Sustainability-Linked Loan

Understanding Biodiversity Management: Best Practices and Innovation

Episode 29: What 20 Years of ESG Engagement Can Teach Us About the Future

BMO Financial Group 2020 Sustainability Report and Public Accountability Statement Now Available Online

Episode 28: Bloomberg: Enhancing ESG Disclosure through Data-Driven Solutions

BMO Ranked Among Most Sustainable Companies on Dow Jones Sustainability Index - North America

BMO investing in a sustainable future with $1M donation to the Institute for Sustainable Finance

BMO Financial Group Reaches Key Milestone in Matching 100 Per Cent of Electricity Usage with Renewables

BMO Financial Group Recognized as One of the World's Most Sustainably Managed Companies in New Wall Street Journal Ranking

Episode 23: TC Transcontinental – A Market Leader in Sustainable Packaging

BMO Financial Group to Source 100 Per Cent of Electricity Usage From Renewables

Episode 07: World Bank: Mobilizing Capital Markets for Sustainable Finance

Episode 06: Responsible Investing – Industry Trends and Best Practices from Canada