Extraordinary New Drivers Mean U.S. M&A has Room to Run

-

bookmark

-

print

That we’re living through one of the most robust M&A markets in living memory will not come as news to anyone. That markets are firing on all cylinders may also be obvious, as deal making is driven by cheap money, soaring equity values and a view to economic recovery from the global pandemic.

Less obvious, perhaps, is that as well as all of the traditional drivers of M&A, some entirely new factors have come into play, like the wave of deals coming to market after being put on hold when the pandemic hit, or the inflow of foreign capital chasing a share in America’s growth, or the advent of SPACs (Special Purpose Acquisition Companies). Add to that the concerns that tax laws may change under the new presidential administration, and companies have another reason to think of transacting sooner than later.

What it all adds up to is that this record-setting boom in deal making has room to run, and that one of the most robust M&A markets in living memory has the potential to continue through 2022.

Emboldened Boards

The litany of green lights driving M&A, from low interest rates to private equity funds bursting with dry powder, supportive debt markets and an equity market where stocks are trading handsomely and at very robust levels, are all emboldening boardrooms to do M&A activity.

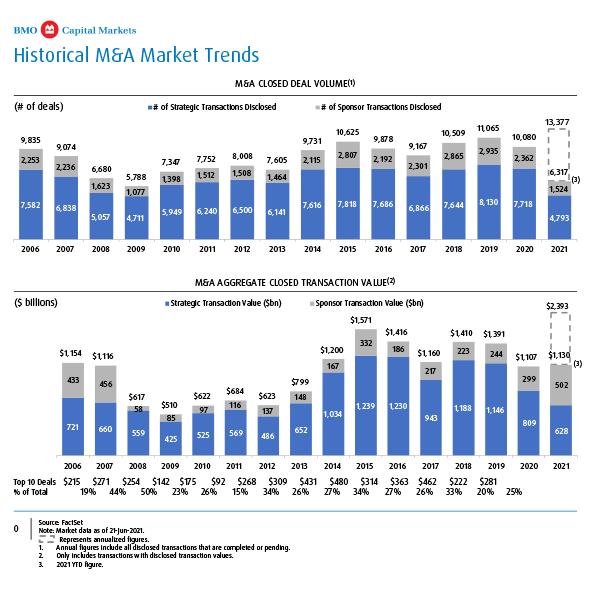

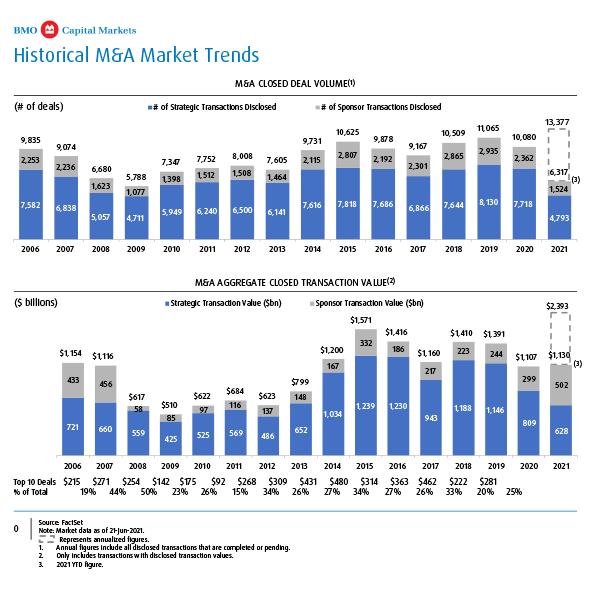

As of midyear, US announced M&A deal volumes had already matched and surpassed the figures for all of fiscal 2020, when most deal making in America skid to a halt with the onset of the pandemic and remained in a lull that lasted until October. These numbers are suggesting we are on pace to see double the amount of deal activity as last year and about 50 percent more compared to 2019, prior to the pandemic.

M&A activity typically gets done in two different scenarios: defensive in difficult scenarios, such as the pandemic, or offensive, when the outlook is good – note calls for an unprecedented rebound in Canada and the United States. In the past 15 months we have seen both. At first, much of the activity was defensive, as companies joined forces to better weather the impacts of the pandemic, but as America fortified its response to COVID-19, including a vaccination campaign that took it from global laggard to a leader in the fight against the disease, companies went on the offensive, pushing deal volumes and values to historic highs.

The New Drivers: SPACs, Tax and the Pandemic Backlog

The most obvious new factor is the deployment of the pre-pandemic pipeline. As the pandemic hit last year, many companies put sale processes on hold as lockdowns made it impossible to conduct normal deal activities like due diligence or in situ plant visits. The world adjusted, however. At BMO we became more efficient, leveraging our holistic digital capabilities to help execute transactions remotely and despite lockdowns. In fact, that is not a trend that will go away as economies reopen; we’ll never eliminate the need to have physical contact, to meet in person, but that will become complementary to the process as we exit the pandemic.

Also significant to higher deal flow are the trillions of dollars that the US administration has, or is planning to, put toward relief and infrastructure. Invariably, this fuels economic recovery and deal flow, which creates optimism for the future, like recent forecasts for a sharp economic rebound in the United States and Canada.

An enormously green and absolute driver of M&A activity has been the emergence of SPACs into the mainstream, bringing some $600 billion in additional, legitimately competitive buying power to a market that has traditionally been limited to corporate, strategic buyers and financial buyers, like private equity firms or family offices.

To be clear, SPACs have been around for decades, but they have only recently come into the mainstream as blue chip private equity firms and well-known public company operators lent credibility to the product, driving highly successful outcomes for target companies and impressive returns for market participants. These days, in addition to their size, SPACs also bring a new kind of urgency to deal making because of their need to transact on an acquisition within 24 months of going public.

As of the latest count there are over 400 SPACs chasing acquisitions.

Yet another driver comes in the shape, not in what is occurring today, but rather speculation about the near future, namely concerns of a potential increase in corporate tax rates under the new administration. The possibility of more tax on capital gains is driving some players, including private equity firms that hold trillions in assets, along with privately held businesses, to transact before potential changes would take effect.

Flight of Capital to U.S. Markets

Finally, there is the flight of capital to North American stock markets and US-based companies, a testament to the strength of America’s deal pipeline and to the belief that these are the most stable economies, where the pandemic is most under control. There is a sense that a disproportionate share of the recovery from COVID-19, and deal activity, is to be had in the United States especially.

Since deal flow came back to the market in October, there are few sectors that are not witnessing a surge in activity, with mega deals driving M&A volumes at high premiums and with significant stock considerations. Take for example General Electric Co.’s $30 billion deal in March to sell its aircraft leasing business to Ireland’s AerCap Holdings NV. And in the midcap space, in June BMO Capital Markets acted as joint financial advisor to McGraw Hill Education, Inc., a portfolio company of Apollo Global Management, Inc. in the sale of the company to Platinum Equity for some $4.5 billion. The transaction was BMO’s fifth multi-billion U.S. advisory assignment in three months and followed our role as exclusive financial advisor to Performance Food Group Company (PFG), a foodservice distributor, in its $2.5 billion acquisition of Core-Mark Holding Company, Inc., one of the largest wholesale distributors to the convenience retail industry in North America.

Going forward, robust stock prices will continue to fuel stock-for-stock transactions and drive boardroom confidence in a market that will reward strategic transactions when they can find an appealing partnering company to acquire.

However, there are some potential clouds gathering on the horizon, to be sure. Worries about a rise in interest rates - should current inflation be more than transitory - and the subsequent impact on debt burdens, may take some wind out of the sails for those weighing acquisitions. It is also not lost on anybody in the business that we are in a bull run that is in its 11th year and has already defied the odds.

You’d be hard pressed to find a banker who will make predictions five years out but, all things considered, and barring an enormous backstep in the pandemic or disruptive geopolitical event, the market likely has enough momentum to carry it through until at least the end of 2022, even if some of the green lights start to turn yellow or even red. After all, the SPAC space alone has enough unspent powder to fuel activity for some time

For more information contact: lyle.wilpon@bmo.com

Additional Resource

In this BMO-sponsored episode of Bloomberg Invest Talks Marc Rowan, co-founder and newly minted CEO of Apollo Global Management, discusses his views on the future of investing and what’s in store for his investing powerhouse firm. Watch the Bloomberg video.

Extraordinary New Drivers Mean U.S. M&A has Room to Run

Vice Chair, Investment Banking

Lyle Wilpon is the Vice Chairman of Investment Banking at BMO Capital Markets. He is a senior member of the Mergers & Acquisitions team, having led the Global A…

Lyle Wilpon is the Vice Chairman of Investment Banking at BMO Capital Markets. He is a senior member of the Mergers & Acquisitions team, having led the Global A…

VIEW FULL PROFILE-

Minute Read

-

Listen

Stop

-

Text Bigger | Text Smaller

That we’re living through one of the most robust M&A markets in living memory will not come as news to anyone. That markets are firing on all cylinders may also be obvious, as deal making is driven by cheap money, soaring equity values and a view to economic recovery from the global pandemic.

Less obvious, perhaps, is that as well as all of the traditional drivers of M&A, some entirely new factors have come into play, like the wave of deals coming to market after being put on hold when the pandemic hit, or the inflow of foreign capital chasing a share in America’s growth, or the advent of SPACs (Special Purpose Acquisition Companies). Add to that the concerns that tax laws may change under the new presidential administration, and companies have another reason to think of transacting sooner than later.

What it all adds up to is that this record-setting boom in deal making has room to run, and that one of the most robust M&A markets in living memory has the potential to continue through 2022.

Emboldened Boards

The litany of green lights driving M&A, from low interest rates to private equity funds bursting with dry powder, supportive debt markets and an equity market where stocks are trading handsomely and at very robust levels, are all emboldening boardrooms to do M&A activity.

As of midyear, US announced M&A deal volumes had already matched and surpassed the figures for all of fiscal 2020, when most deal making in America skid to a halt with the onset of the pandemic and remained in a lull that lasted until October. These numbers are suggesting we are on pace to see double the amount of deal activity as last year and about 50 percent more compared to 2019, prior to the pandemic.

M&A activity typically gets done in two different scenarios: defensive in difficult scenarios, such as the pandemic, or offensive, when the outlook is good – note calls for an unprecedented rebound in Canada and the United States. In the past 15 months we have seen both. At first, much of the activity was defensive, as companies joined forces to better weather the impacts of the pandemic, but as America fortified its response to COVID-19, including a vaccination campaign that took it from global laggard to a leader in the fight against the disease, companies went on the offensive, pushing deal volumes and values to historic highs.

The New Drivers: SPACs, Tax and the Pandemic Backlog

The most obvious new factor is the deployment of the pre-pandemic pipeline. As the pandemic hit last year, many companies put sale processes on hold as lockdowns made it impossible to conduct normal deal activities like due diligence or in situ plant visits. The world adjusted, however. At BMO we became more efficient, leveraging our holistic digital capabilities to help execute transactions remotely and despite lockdowns. In fact, that is not a trend that will go away as economies reopen; we’ll never eliminate the need to have physical contact, to meet in person, but that will become complementary to the process as we exit the pandemic.

Also significant to higher deal flow are the trillions of dollars that the US administration has, or is planning to, put toward relief and infrastructure. Invariably, this fuels economic recovery and deal flow, which creates optimism for the future, like recent forecasts for a sharp economic rebound in the United States and Canada.

An enormously green and absolute driver of M&A activity has been the emergence of SPACs into the mainstream, bringing some $600 billion in additional, legitimately competitive buying power to a market that has traditionally been limited to corporate, strategic buyers and financial buyers, like private equity firms or family offices.

To be clear, SPACs have been around for decades, but they have only recently come into the mainstream as blue chip private equity firms and well-known public company operators lent credibility to the product, driving highly successful outcomes for target companies and impressive returns for market participants. These days, in addition to their size, SPACs also bring a new kind of urgency to deal making because of their need to transact on an acquisition within 24 months of going public.

As of the latest count there are over 400 SPACs chasing acquisitions.

Yet another driver comes in the shape, not in what is occurring today, but rather speculation about the near future, namely concerns of a potential increase in corporate tax rates under the new administration. The possibility of more tax on capital gains is driving some players, including private equity firms that hold trillions in assets, along with privately held businesses, to transact before potential changes would take effect.

Flight of Capital to U.S. Markets

Finally, there is the flight of capital to North American stock markets and US-based companies, a testament to the strength of America’s deal pipeline and to the belief that these are the most stable economies, where the pandemic is most under control. There is a sense that a disproportionate share of the recovery from COVID-19, and deal activity, is to be had in the United States especially.

Since deal flow came back to the market in October, there are few sectors that are not witnessing a surge in activity, with mega deals driving M&A volumes at high premiums and with significant stock considerations. Take for example General Electric Co.’s $30 billion deal in March to sell its aircraft leasing business to Ireland’s AerCap Holdings NV. And in the midcap space, in June BMO Capital Markets acted as joint financial advisor to McGraw Hill Education, Inc., a portfolio company of Apollo Global Management, Inc. in the sale of the company to Platinum Equity for some $4.5 billion. The transaction was BMO’s fifth multi-billion U.S. advisory assignment in three months and followed our role as exclusive financial advisor to Performance Food Group Company (PFG), a foodservice distributor, in its $2.5 billion acquisition of Core-Mark Holding Company, Inc., one of the largest wholesale distributors to the convenience retail industry in North America.

Going forward, robust stock prices will continue to fuel stock-for-stock transactions and drive boardroom confidence in a market that will reward strategic transactions when they can find an appealing partnering company to acquire.

However, there are some potential clouds gathering on the horizon, to be sure. Worries about a rise in interest rates - should current inflation be more than transitory - and the subsequent impact on debt burdens, may take some wind out of the sails for those weighing acquisitions. It is also not lost on anybody in the business that we are in a bull run that is in its 11th year and has already defied the odds.

You’d be hard pressed to find a banker who will make predictions five years out but, all things considered, and barring an enormous backstep in the pandemic or disruptive geopolitical event, the market likely has enough momentum to carry it through until at least the end of 2022, even if some of the green lights start to turn yellow or even red. After all, the SPAC space alone has enough unspent powder to fuel activity for some time

For more information contact: lyle.wilpon@bmo.com

Additional Resource

In this BMO-sponsored episode of Bloomberg Invest Talks Marc Rowan, co-founder and newly minted CEO of Apollo Global Management, discusses his views on the future of investing and what’s in store for his investing powerhouse firm. Watch the Bloomberg video.

Road to Recovery 2021

PART 1

North American Investment Strategy: 2021 Market Outlook

Brian Belski February 04, 2021

While 2020 has been a challenging year, it’s also highlighted our resilience and determination. Those qualities were evident in the U…

PART 2

COVID-19: The Biden Presidency and What Lies Ahead

Brian Belski, Michael Gregory, CFA, None January 26, 2021

With Joe Biden sworn in as the 46th U.S. president, and on the day Canada marked the one-year anniversary of its first confirmed COVID-19 c…

PART 3

NextGen Treasury: Your Digital Roadmap

Marc-Andre Bergeron February 09, 2021

Digitizing payments has become more important than ever as organizations look to increase working capital, create efficiencies, potentially…

PART 4

Deep Dive into Debt - How Retail Borrowed to Health through COVID

Simeon Siegel, CFA April 06, 2021

More retailers are borrowing under COVID than during the Global Financial Crisis Retailers have borrowed multiples higher tha…

PART 5

The ‘E’, ‘S’ and ‘G’ in Mining

Magali Gable April 21, 2021

At our 30th Annual Global Metals & Mining Conference this year, producer after producer engaged on the subject of sustainable mining in…

PART 6

The Changing Landscape of U.S. Trading

None May 21, 2021

Changes to rule 606(b), the transparency and the NMS market data rule will increase data transparency and level the playing field for…

PART 7

COVID-19: Biden's First 100 Days: Tracking the Road to Recovery

Dan Barclay June 14, 2021

With President Joe Biden cresting the first 100 days of his administration, experts are forecasting a strong economic rebound in the United…

PART 8

IN Tune: Food and Ag Takeaways From the Farm to Market Conference

Joel Jackson, P.Eng., CFA, Kelly Bania July 02, 2021

IN Tune is a podcast featuring Equity Research analysts from BMO Capital Markets. Our episodes explore key emerging themes, trend…

PART 10

Accelerating the Road to Recovery

Dan Barclay August 16, 2021

What kind of headwinds can we expect and what are the risks? Will inflation woes drive a change in monetary policy? BMO Capital Markets…

PART 11

The Delta Surge and Impacts on a Reopening

Brian Belski October 27, 2021

On September 28, BMO hosted a panel to provide an update on the current state of the pandemic and an outlook on what it means for the marke…

PART 12

The Best of Both Worlds: The Future of Work in Capital Markets

Dan Barclay October 07, 2021

It’s not that long ago that the physical pitch book was entrenched in deal-making lore, for decades thumped down on boardroom tables …

You might also be interested in

Private Equity Is Still in Risk-on Mode, but It’s Picking Its Spots

Op Ed: Businesses and Community Organizations Need to Come Together to Fight Poverty

Biggest Trends in Food and Ag, From ESG to Inflation to the Supply Chain

Cloud, Data and Zero-trust: Here’s Where VCs are Putting Their Cybersecurity Investments

BMO Announces $250,000 Donation to Organizations Supporting Global Emergency COVID-19 Relief Efforts

Canada Eyes Biggest Economic Rebound in Half a Century, Plots Equitable Recovery - Panel

Leading with Resiliency: Highlights from BMO’s Forum for Executive Women

Ian Bremmer in Conversation: The Pandemic and a Changing Geopolitical Landscape

COVID-19 Puts Spotlight on Strong Liquidity Management, Antifraud Practices

Canada's Six Biggest Banks Take Decisive Action To Help Customers Impacted by COVID-19