A First in Western Canada: Avenue Living Leverages BMO's Retrofit Program to Add 179 New Rental Units in Downtown Edmonton

-

bookmark

-

print

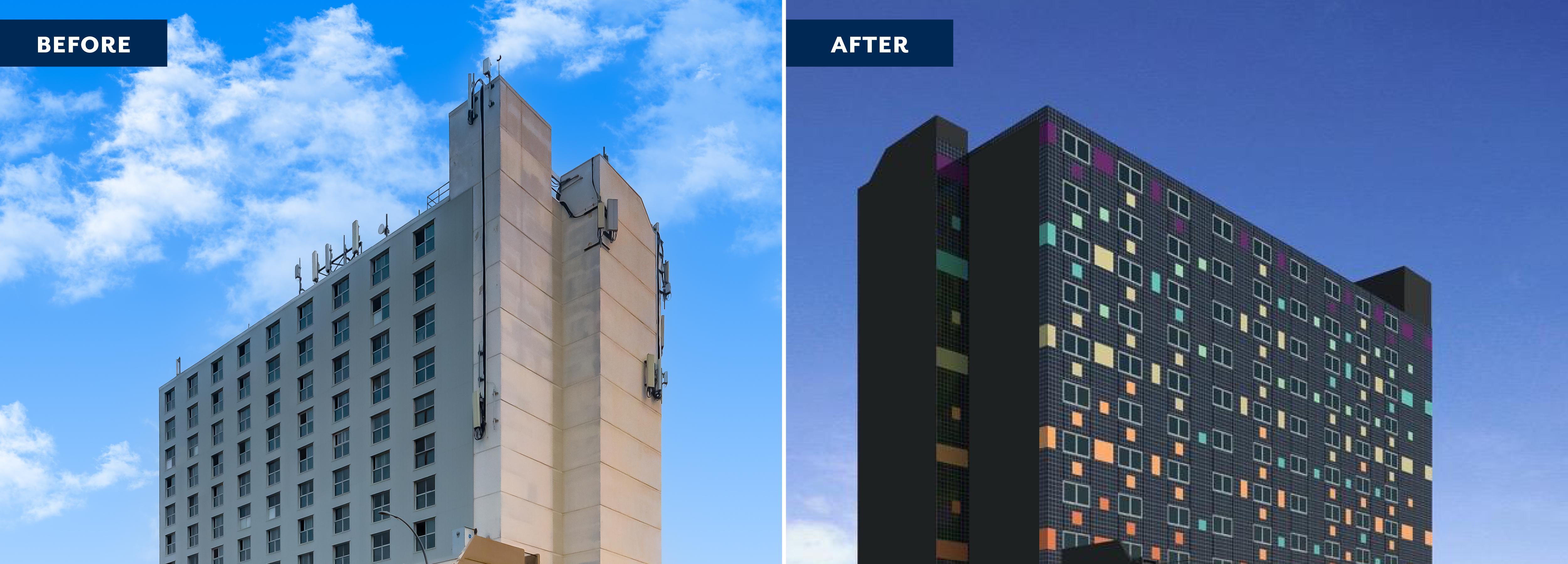

CALGARY, AB, April 29, 2024 /CNW/ - Avenue Living Asset Management, Ltd. (Avenue Living) is proud to announce an innovative funding partnership with BMO to revitalize a mixed-use multi-family residential and commercial building at 10609 101st Street NW in Edmonton, Alberta. The nearly $28 million project was made possible through BMO's short-term retrofit financing program and includes energy retrofits and sustainability upgrades that are expected to reduce the building's greenhouse gas emissions by up to 64 per cent. Additionally, with a current purpose-built rental vacancy rate of 2.4 per cent in the city, the project's 179 new units will significantly contribute to meeting the demand for housing in Edmonton's downtown core.

"As part of our Purpose, to Boldly Grow the Good in business and life, BMO is committed to being our clients' lead partner in the transition to a net-zero world," said Jeffrey Shell, Head of Alternatives, Commercial ESG and Innovation, BMO Global Asset Management. "Greenhouse gas emissions from buildings make up a large proportion of Canada's total emissions profile, requiring extensive energy retrofits to get to net zero. The BMO Retrofit Program is a testament to the way we collaborate across the bank, and partner with organizations and clients, to create new and effective sustainable solutions."

"We're excited to work with BMO on this project and retrofit our landmark 49-year-old building for the Edmonton community," said Jason Jogia, Chief Investment Officer, Avenue Living. "The BMO retrofit program supports our responsible investment goal to offer workforce housing residents with a high quality, affordable, and comfortable living experience for years to come."

"The renovation of this building is expected to inspire more projects like it in the downtown area, which will bring in more investment and create a fresh, lively atmosphere in the neighbourhood," notes Daniel Veniot, Avenue Living's Associate Vice President of Debt Capital Markets. "By investing in this asset, we are introducing new units in Edmonton to support a targeted demographic of essential workers, young professionals, and students, while ensuring that we're doing it in an environmentally friendly way."

"This retrofit sets a new standard for ambitious and forward-thinking development in the real estate sector," said Mike Beg, Head, Real Estate Finance, BMO Commercial Bank, Canada. "It's imperative to have collaborative partnerships with key players in the multi-family space so that we can advance sustainable finance initiatives to positively impact the community."

BMO and Sustainability

Carbon neutral in its own operations since 2010, BMO announced in March 2021 its Climate Ambition to be its clients' lead partner in the transition to a net-zero world. Since 2019, BMO has mobilized $330 billion in capital to clients pursuing sustainable outcomes, surpassing its commitment of $300 billion by 2025. This support included sustainable bond underwriting, loans to clients and projects pursuing sustainable outcomes, sustainable equity and debt financing, sustainable finance advisory services, and sustainable investments. In 2021, BMO launched the BMO Climate Institute and established a dedicated Energy Transition Group, to support clients' pursuit of opportunities driven by the increasing momentum of the global economy's shift in production and consumption of energy.

For information on BMO's Sustainable Real Estate initiatives, click here.

For information on BMO's Purpose and commitments to a sustainable future, visit its Sustainability Report, Purpose, Climate and Zero Barriers to Inclusion 2025 pages.

About BMO Financial Group

BMO Financial Group is the eighth largest bank in North America by assets, with total assets of $1.3 trillion as of January 31, 2024. Serving customers for 200 years and counting, BMO is a diverse team of highly engaged employees providing a broad range of personal and commercial banking, wealth management, global markets and investment banking products and services to 13 million customers across Canada, the United States, and in select markets globally. Driven by a single purpose, to Boldly Grow the Good in business and life, BMO is committed to driving positive change in the world, and making progress for a thriving economy, sustainable future, and inclusive society.

About Avenue Living Asset Management

Avenue Living offers an efficient way for investors to add real estate investments to their portfolios. Founded in 2006, the organization has grown to $6 billion in assets under management across Canada and the United States. The organization's real estate investment funds focus on assets that touch the everyday lives of North Americans — workforce housing, self-storage, and farmland. Avenue Living has strategically built a proprietary platform that supports a customer-centric management model, driving value for its customers, investors, and employees.

For information on Avenue Living's Sustainable Real Estate initiatives, visit its Responsibility page.

Avenue Living Media Contact: Tammy Cho, Calgary, tcho@avenueliving.ca; BMO Media Contact: Kelly Hechler, Toronto, kelly.hechler@bmo.com, (416) 867-3996

Read the feature in the Edmonton Journal.

A First in Western Canada: Avenue Living Leverages BMO's Retrofit Program to Add 179 New Rental Units in Downtown Edmonton

-

Minute Read

-

Listen

Stop

-

Text Bigger | Text Smaller

CALGARY, AB, April 29, 2024 /CNW/ - Avenue Living Asset Management, Ltd. (Avenue Living) is proud to announce an innovative funding partnership with BMO to revitalize a mixed-use multi-family residential and commercial building at 10609 101st Street NW in Edmonton, Alberta. The nearly $28 million project was made possible through BMO's short-term retrofit financing program and includes energy retrofits and sustainability upgrades that are expected to reduce the building's greenhouse gas emissions by up to 64 per cent. Additionally, with a current purpose-built rental vacancy rate of 2.4 per cent in the city, the project's 179 new units will significantly contribute to meeting the demand for housing in Edmonton's downtown core.

"As part of our Purpose, to Boldly Grow the Good in business and life, BMO is committed to being our clients' lead partner in the transition to a net-zero world," said Jeffrey Shell, Head of Alternatives, Commercial ESG and Innovation, BMO Global Asset Management. "Greenhouse gas emissions from buildings make up a large proportion of Canada's total emissions profile, requiring extensive energy retrofits to get to net zero. The BMO Retrofit Program is a testament to the way we collaborate across the bank, and partner with organizations and clients, to create new and effective sustainable solutions."

"We're excited to work with BMO on this project and retrofit our landmark 49-year-old building for the Edmonton community," said Jason Jogia, Chief Investment Officer, Avenue Living. "The BMO retrofit program supports our responsible investment goal to offer workforce housing residents with a high quality, affordable, and comfortable living experience for years to come."

"The renovation of this building is expected to inspire more projects like it in the downtown area, which will bring in more investment and create a fresh, lively atmosphere in the neighbourhood," notes Daniel Veniot, Avenue Living's Associate Vice President of Debt Capital Markets. "By investing in this asset, we are introducing new units in Edmonton to support a targeted demographic of essential workers, young professionals, and students, while ensuring that we're doing it in an environmentally friendly way."

"This retrofit sets a new standard for ambitious and forward-thinking development in the real estate sector," said Mike Beg, Head, Real Estate Finance, BMO Commercial Bank, Canada. "It's imperative to have collaborative partnerships with key players in the multi-family space so that we can advance sustainable finance initiatives to positively impact the community."

BMO and Sustainability

Carbon neutral in its own operations since 2010, BMO announced in March 2021 its Climate Ambition to be its clients' lead partner in the transition to a net-zero world. Since 2019, BMO has mobilized $330 billion in capital to clients pursuing sustainable outcomes, surpassing its commitment of $300 billion by 2025. This support included sustainable bond underwriting, loans to clients and projects pursuing sustainable outcomes, sustainable equity and debt financing, sustainable finance advisory services, and sustainable investments. In 2021, BMO launched the BMO Climate Institute and established a dedicated Energy Transition Group, to support clients' pursuit of opportunities driven by the increasing momentum of the global economy's shift in production and consumption of energy.

For information on BMO's Sustainable Real Estate initiatives, click here.

For information on BMO's Purpose and commitments to a sustainable future, visit its Sustainability Report, Purpose, Climate and Zero Barriers to Inclusion 2025 pages.

About BMO Financial Group

BMO Financial Group is the eighth largest bank in North America by assets, with total assets of $1.3 trillion as of January 31, 2024. Serving customers for 200 years and counting, BMO is a diverse team of highly engaged employees providing a broad range of personal and commercial banking, wealth management, global markets and investment banking products and services to 13 million customers across Canada, the United States, and in select markets globally. Driven by a single purpose, to Boldly Grow the Good in business and life, BMO is committed to driving positive change in the world, and making progress for a thriving economy, sustainable future, and inclusive society.

About Avenue Living Asset Management

Avenue Living offers an efficient way for investors to add real estate investments to their portfolios. Founded in 2006, the organization has grown to $6 billion in assets under management across Canada and the United States. The organization's real estate investment funds focus on assets that touch the everyday lives of North Americans — workforce housing, self-storage, and farmland. Avenue Living has strategically built a proprietary platform that supports a customer-centric management model, driving value for its customers, investors, and employees.

For information on Avenue Living's Sustainable Real Estate initiatives, visit its Responsibility page.

Avenue Living Media Contact: Tammy Cho, Calgary, tcho@avenueliving.ca; BMO Media Contact: Kelly Hechler, Toronto, kelly.hechler@bmo.com, (416) 867-3996

Read the feature in the Edmonton Journal.

You might also be interested in

BMO Capital Markets to Host 34th Annual Global Metals, Mining & Critical Minerals Conference, Feb 23 - Feb 26

BMO Employees Donate $31 Million - and Counting - to Help Communities Thrive

BMO and Canal Road Group Form Strategic Partnership Aimed at Providing Direct Lending to Upper Middle-Market Companies

A Buyer’s Guide to Corporate Offsetting and Navigating the Voluntary Carbon Market

BMO Financial Group Increases Common Share Dividend by 4 cents from the prior quarter, up 5 per cent from the prior year

Why Sustainability Is Good Business: Key Takeaways from IEFA Toronto 2024

Building for Tomorrow: Real Estate, Construction, and Sustainability

BMO's 20th Equity Through Education Trading Day Raises C$1.5 Million to Promote Education, Development and Progress for Promising Students Around the World

BMO Named Best Private Bank and Retail Bank in Canada and Best Commercial Bank in US and Canada

BMO Financial Group Increases Common Share Dividend by 4 cents from the prior quarter, up 5 per cent from the prior year

Inaugural BMO Wine Market Report: U.S. Wineries Optimistic about Sustained Sales Growth Over Next 5 Years

The Future of Food: Global Food and Agriculture Trends and Outlook BMO Hosts 19th Farm to Market | Chemicals Conference in New York

Expanded Latino Leaders Index500, Powered by BMO Ranks Top U.S. Latino-Owned Businesses

Record Investor Attendance Expected at BMO's 33rd Global Metals, Mining & Critical Minerals Conference, February 25th to February 28th, 2024

How NASA and IBM Are Using Geospatial Data and AI to Analyze Climate Risks

BMO Establishes new U.S. Wine Industry Partnership, Enhancing Offering for Wine and Spirits Industry

BMO Arranges Green Financing to Fund New Lawson Centre for Sustainability, Trinity College's Most Significant Build in a Century

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

Canada Has an Opportunity to Become a Global Leader in Carbon Dioxide Removal

BMO Financial Group Increases Common Share Dividend by 4 cents from the prior quarter, up 6 per cent from the prior year

More Companies Have Plans to Address Climate Change Based on Rising Business Importance: Survey Results

BMO Climate Institute Business Leaders Survey: Nearly Half of Business Leaders in the U.S. and Canada Believe Climate Change Has Already Affected Their Businesses, but Few Have a Strategy

BMO Blue Book: U.S. Economy is Resilient but Predicted to Slow in Early 2024

How the Energy Sector Is Helping Canada Achieve Its Decarbonization Goals

BMO Announces Retirement of Dan Barclay, Names Alan Tannenbaum CEO, BMO Capital Markets

Transforming the Global Food System to Benefit Investors and the Planet

Why Businesses Need to Accelerate Their Efforts to Fight Climate Change

BMO's 19th Equity Through Education Trading Day Raises C$1.65 Million to Promote Education, Development and Progress for Promising Students Around the World

BMO Donates $3 Million to GRID Alternatives to Provide Solar Energy Solutions for Low-Income Families

Banco do Brasil and BMO Financial Group to Introduce First-of-its-Kind Program to Provide Sustainability-Linked Trade Loans Supporting Brazilian Exporters

BMO Provides Innovative New Sustainability-Linked Deposit Product to Zurn Elkay Water Solutions

Quick Listen: Michael Torrance on Empowering Your Organization to Operationalize Sustainability

BMO Marks National Indigenous History Month and National Indigenous Peoples Day with Support for Indigenous-Led Organizations that Empower Communities

BMO and Bell Canada Execute Innovative Sustainability-Linked Derivative Tied to Ambitious GHG Emission Reduction Targets

BMO Financial Group Increases Common Share Dividend by 4 cents from the prior quarter, up 6 per cent from the prior year

BMO Named to UN-Convened Group Providing Guidance to Global Banks on Nature Target Setting

Global Food and Agriculture Trends and Outlook: BMO Hosts 18th Farm to Market | Chemicals Conference in New York

Driving Innovations In Tech To Strengthen Climate Resilience With Climate Engine’s Spatiafi, Built On Google Cloud

BMO Celebrates Earth Day with 3rd Annual Trees from Trades Day on its Global Trading Floors

BMO Donates $2 Million to the University of Saskatchewan to Accelerate Research Critical to the Future of Food

North America’s Critical Minerals Advantage: Deep Dive on Community Engagement

BMO Capital Markets CEO Dan Barclay named Male Ally of the Year by Financial Women's Association

Rock Legends Reflect on Mining Hits and Misses: Global Metals, Mining & Critical Minerals Conference

Exploring North America’s Critical Minerals Advantage: Global Metals, Mining & Critical Minerals Conference

The Most Valuable Commodity is Trust: ICMM to BMO Global Metals, Mining & Critical Minerals Conference

BMO Experts at our 32nd Global Metals, Mining & Critical Minerals Conference

Evolving Mining for a Sustainable Energy Transition: ICMM CEO Rohitesh Dhawan in Conversation

Public Policy and the Energy Transition: Howard Learner in Conversation

Taskforce on Nature-Related Financial Disclosure (TNFD) – A Plan for Integrating Nature into Business

Takeaways from the BMO Climate Institute Small and Mid-Sized Businesses Climate Survey

BMO Ranked North America's Most Sustainable Bank by Corporate Knights for Fourth Consecutive Year

Is Green Financing for Nuclear the Next Frontier in the Energy Transition?

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

Top Rankings for BMO Capital Markets' FICC Macro Strategy Group in Institutional Investor Client Survey

BMO Climate Institute Survey Shows Costs and Competing Priorities Slowing Climate Action for Small and Mid-Sized Businesses

Managing and Monetizing Your Transition to a Net Zero World with BMO and Radicle

BMO Financial Group Increases Common Share Dividend by 4 cents from the prior quarter, up 8 per cent from the prior year

BMO the Top Ranked Financial Institution on New Global Sustainability Benchmark Announced at COP 27

The Government of Canada announces the issuance of a Ukraine Sovereignty Bond

COP27 in Focus: Will Energy Security and Economic Uncertainty Impact the Climate Transition?

BMO to Invest in Innovative Carbon Offsets from CarbonCure to Permanently Store CO2

The Financial Women's Association Underscores Its Commitment to the Back2Business™ Return-to-Work Program

RoadMap Project: An Indigenous-led Paradigm Shift for Economic Reconciliation

A Canadian First: BMO and Concordia University Partner for a Sustainable Future with Innovative Sustainability-Linked Loan

BMO's 18th Global Equity Through Education Trading Day Raises C$1.65 Million for Education and Development of Students in Need

BMO Capital Markets Trading Floors in Toronto, New York and London Promote Equity Through Education for 18th Year to Provide Financial Aid to Students

Sustainability Strategy and Reporting for Small and Medium Sized Companies: A Discussion at the Conference of Montreal

BMO to Acquire Calgary-based Radicle Group Inc., a Leader in Environmental Services

Investment Opportunities for a Net-Zero Economy: A Conversation at the Milken Institute Global Conference

How Hope, Grit, and a Hospital Network Saved Maverix Private Capital Founder John Ruffolo

Hydrogen’s Role in the Energy Transition: Matt Fairley in Conversation

Exploring the Physical and Transition Risks Facing Food and Agriculture

Key Takeaways on Ag, Food, Fertilizer & ESG from BMO’s Farm to Market Conference

BMO Financial Group Increases Common Share Dividend by 6 cents from the prior quarter, up 31 per cent from the prior year

Building an ESG Business Case in the Food Sector: The Food Institute

BMO Expands Electronic Trading Operations for Institutions and Broker Dealers to EMEA Markets

BMO and EDC Announce Collaboration to Introduce Sustainable Finance Solutions for Canadian Businesses

Retrofitting Canada's Building Sector: Efficiency Canada’s Corey Diamond in Conversation

The Role of Hydrogen in the Energy Transition: FuelCell Energy CEO Jason Few in Conversation

BMO joins leading US banks in support of Ownership Works, to help create wealth for working families through employee ownership programs

BMO proud to support first Government of Canada Green Bond transaction as joint-lead manager

Tackling Climate Change in Metals and Mining: ICMM CEO Rohitesh Dhawan in Conversation

Op Ed: Government Action Can Help Spur More Home Building To Address Canada’s Housing Shortage

BMO Supports Women Entrepreneurs in Canada with $5 Billion in Capital to Mark International Women’s Day 2022

BMO Launches Business Within Reach: BMO for Black Entrepreneurs and Commits $100 million in loans to Help Black-led Businesses Start up, Scale up, and Grow

The Post 2020 Biodiversity Framework – A Discussion with Basile Van Havre

BMO Announces Plan to Partner with Breakthrough Energy Catalyst to Accelerate Climate Innovation

BMO Financial Group Named North America's Most Sustainable Bank for Third Consecutive Year

Mitigating the Physical Impacts of Climate Change with Spatial Finance

BMO Financial Group accelerates North American growth with strategic acquisition of Bank of the West

BMO Capital Markets Named Best Canadian Bank for USD/CAD for 11th Consecutive Year

BMO Financial Group Increases Common Share Dividend by 27 cents from the prior quarter, up 25 per cent from the prior quarter and prior year

BMO Financial Group Announces Intention to Repurchase Up to 22.5 Million of its Common Shares

BMO Helps Boralex Go Beyond Renewable Energy, with the Transition of its Credit Facility to a Sustainability-Linked Loan

BMO Capital Markets' Fixed Income Strategy Group Earns Top Rankings in Institutional Investor Survey

A Global First: BMO Supports Bruce Power with World's First Nuclear Green Financing Framework

BMO ranked one of the most sustainable companies in the world according to Dow Jones Sustainability Indices

The Future of Remote Work and Diversity in the Asset Management Industry

BMO Celebrates International Day of the Girl 2021 - Participates in New Sustainability Innovation Hub to Inspire Young Women

North American Metals & Mining first: BMO helps Sandstorm Gold Royalties achieve ESG goals with Sustainability-Linked Loan

BMO marks National Day for Truth and Reconciliation with $600,000 in donations to Indigenous organizations across Canada

Education, Employment and Economic Empowerment: BMO Releases Wîcihitowin ᐑᒋᐦᐃᑐᐏᐣ- First Annual Indigenous Partnerships and Progress Report

BMO's 17th Annual Equity Through Education Trading Day Raises C$1.6 Million to Promote Diversity, Equity and Inclusion

Media Advisory - BMO Celebrates 17 Years of Promoting Diversity and Inclusion Through BMO Capital Markets' Equity Through Education Trading Day

BMO Harnesses AI Technology for Capital Markets Structured Note Pricing and Scenario Analysis

BMO Announces $12 Billion Financing Commitment towards Affordable Housing in Canada

BMO supports Canada's bid to host the headquarters of the International Sustainability Standards Board

In support of Canada’s bid to host the headquarters of the International Sustainability Standards Board

BMO Named to Canada's Best 50 Corporate Citizens Ranking by Corporate Knights

Bringing Indigenous Perspectives to Canadians: First Nations University of Canada, Reconciliation Education and BMO launch new eLearning to mark National Indigenous History Month

The Future of Food & Agriculture: BMO Hosts World-Leading Farm to Market Conference for 16th Consecutive Year

Rush University System for Health and BMO Financial Group Announce $10 Million Donation to Create the Rush BMO Institute for Health Equity

BMO Shares Progress on IFC led Operating Principles for Impact Management in First Disclosure Statement

BMO Announces $250,000 Donation to Organizations Supporting Global Emergency COVID-19 Relief Efforts

A North American First: BMO Helps Gibson Energy Fully Transition Credit Facility to a Sustainability-Linked Loan

Understanding Biodiversity Management: Best Practices and Innovation

Forbes names BMO Harris Bank one of the Best Employers for Diversity 2021 for the third year in a row

BMO Issues C$750 million Women in Business Bond In Support of Women-Owned Businesses

BMO Commits $1.2 Million to SheEO Programs Helping Women-Led Venture Companies Access Financing

BMO Named One of the World's Most Ethical Companies by the Ethisphere Institute for the Fourth Year in a Row

BMO Financial Group among first Canadian banks to sign United Nations Principles for Responsible Banking

BMO Financial Group ranked top bank in North America on Corporate Knights' 2021 Global 100 Most Sustainable Corporations in the World

Episode 29: What 20 Years of ESG Engagement Can Teach Us About the Future

BMO Financial Group 2020 Sustainability Report and Public Accountability Statement Now Available Online

BMO Capital Markets Named Best Canadian Bank for USD/CAD for 10th Consecutive Year

Episode 28: Bloomberg: Enhancing ESG Disclosure through Data-Driven Solutions

BMO Ranked Among Most Sustainable Companies on Dow Jones Sustainability Index - North America

BMO investing in a sustainable future with $1M donation to the Institute for Sustainable Finance

BMO Financial Group Reaches Key Milestone in Matching 100 Per Cent of Electricity Usage with Renewables

BMO Financial Group Recognized as One of the World's Most Sustainably Managed Companies in New Wall Street Journal Ranking

BMO Capital Markets to Donate C$1.6 Million Following 16th Annual Equity Through Education Trading Day

Media Advisory - BMO Capital Markets Celebrates 16 Years of the Equity Through Education Trading Day

Episode 23: TC Transcontinental – A Market Leader in Sustainable Packaging

Forbes ranks BMO Harris Bank as one of America’s Best Employers for Women in 2020

Tracking the Recovery: BMO Economics Introduces Canadian Business Activity Index

BMO Capital Markets to host 2020 Prescriptions for Success Healthcare Virtual Conference

BMO Financial Group to Source 100 Per Cent of Electricity Usage From Renewables

Media Advisory - BMO Expert Podcast on COVID-19 and the Future of the Global Economy

Canada's Six Biggest Banks Take Decisive Action To Help Customers Impacted by COVID-19

Maple Leaf Foods and BMO Capital Markets enter into First Sustainability-Linked Loan in Canada

Episode 07: World Bank: Mobilizing Capital Markets for Sustainable Finance

Episode 06: Responsible Investing – Industry Trends and Best Practices from Canada