Innovation in Sustainability-Linked Model Fuels Booming Demand

-

bookmark

-

print

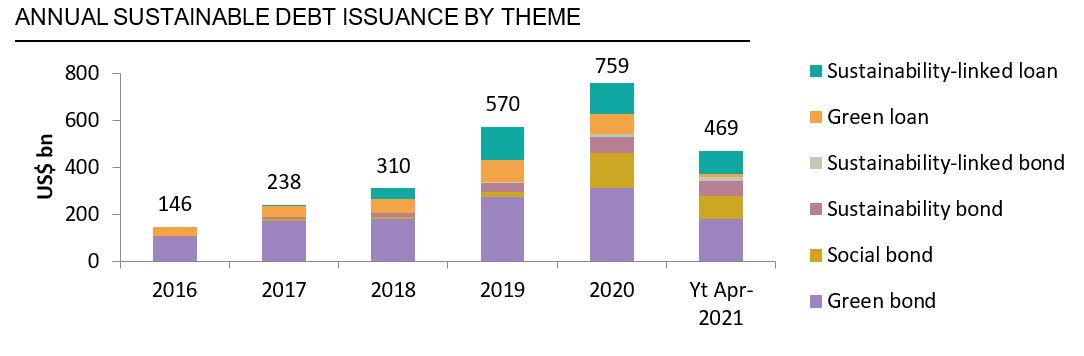

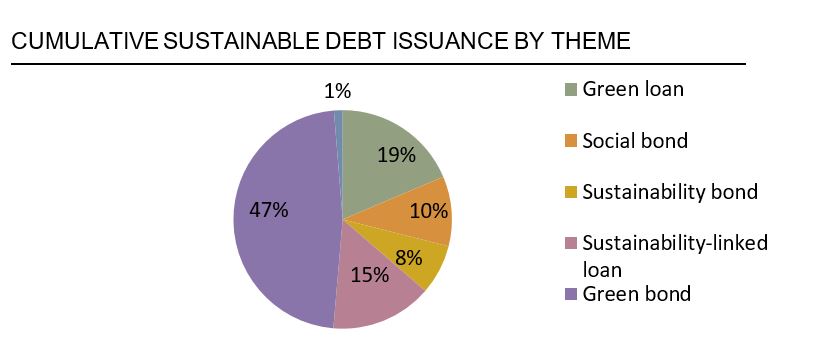

Unstoppable. That’s one word that might describe the recent growth in the sustainable debt market. Driven by its most recent innovation - the so-called sustainability-linked model - the sustainable debt market now exceeds US$2.8tn of issuance across various instruments, eclipsing the US$1tn of issuance that was so trumpeted in the green bond market last year.

Addressing a Market Gap

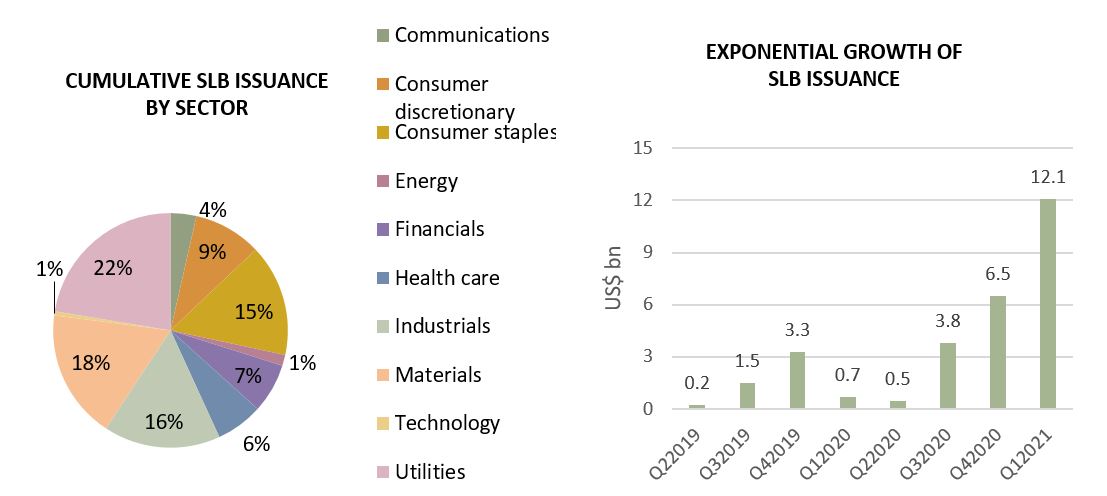

Shortly after the publication of the Sustainability-Linked Bond (“SLB”) Principles in June 2020 (see below) by the International Capital Market Association (“ICMA”), the sustainable debt market witnessed a rocketing number of issuances of those new instruments, reaching US$35.5bn1 as of April 30, 2021 across a wide range of issuers and industries - 65 issuers over 10 industries - evidencing both strong market appetite and acceptance for this new innovative asset class2. The EMEA region has been leading the charge (as it is with sustainable debt in general), with US$24.8bn of issuances, however AMER and APAC regions are following with US$7.33bn and US$3.38bn of issuances, respectively.

The reason for innovation to turn its focus on the development of the sustainability-linked bond asset class is rooted in the need to address a market gap and potential limitations of the Green/Social and Sustainability bonds model. This incredible growth is bolstered by the desire of a broader base of issuers to signal their sustainability strategies and level of commitment to the investment community in an environment where transition taxonomies around the globe are stalling and markets have yet to arrive at a unanimously agreed upon definition of transition. As a result, the sustainability-linked bond market has mirrored the adoption success of the sustainability-linked loan, its cousin in the bank market that has itself roared from 45 issuers in 2018 to 350+ global issuers these days, with a market size of US$422.6bn1 as of April 2021.

The flexibility offered by the bond format, which does not require a dedicated ‘green’ or ‘social’ use of proceeds in the way that traditional Green, Social or Sustainability bonds do, has proven appealing to corporate bond issuers. Indeed, the SLB can be used for general corporate purposes and is meant to motivate the issuer to greater sustainability as a forward-looking instrument. As a result, while the traditional use of proceeds bonds (green/social/sustainability) were pioneered by SSAs, they are so far absent in an SLB market that is dominated by Corporates.

Built-in Incentives Demonstrate Corporate Sustainability Strategy

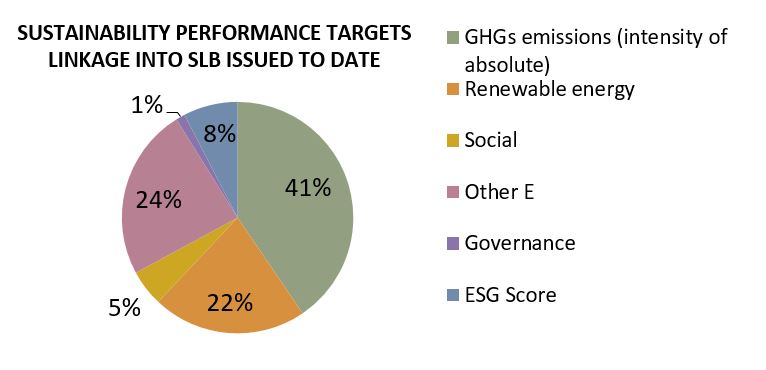

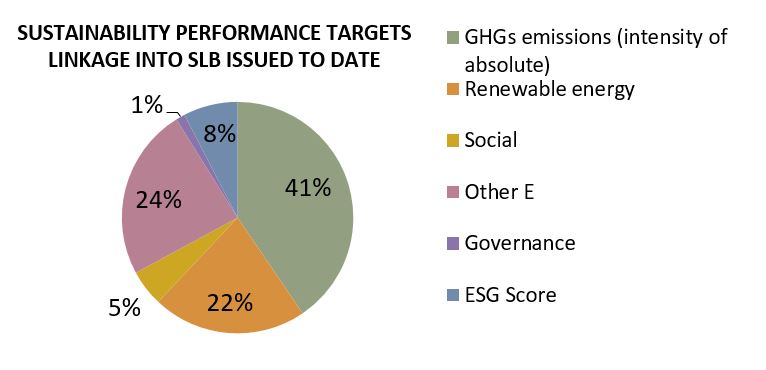

As an increasing number of corporates establish sustainability commitments and targets that encompass a broad range of issues (with the most popular being decarbonization at large), some have doubled down by tying those to financial outcomes built into sustainability-linked bonds.

A sustainability-linked labelled bond implies that either a financial or structural characteristic of the bond will vary depending on achieving pre-agreed Sustainability Performance Targets by a certain date within the life of the bond.

Effectively, in cases where the issuer does not achieve the set targets, most of the US$35.5bn SLBs issued in the market have an interim coupon, step-up feature built into the bond, ranging from 25 to 75bps, possibly spread across several Sustainability Performance Targets. For example, Constellium SE’s US$500mm SLB executed in February of this year will experience a 12.5 basis points coupon step-up in the event that the first sustainability performance target of 25% reduction in GHG emission intensity is not achieved by December 31, 2025, and another 12.5 basis points coupon step-up in 2026 in case of failure to achieve the second 10% increase in recycled aluminum input target. Where the company is successful achieving its targets, the bond characteristics won’t change.

Innovative alternative penalties approaches have also emerged, ultimately supporting achievement of the issuer’s sustainability strategy. In LafargeHolcim’s EUR 850mm SLB transaction executed in November 2020, for example, the 75bps potential coupon step-up could be donated to a research institute active in the fields of climate research or climate change mitigation, or reallocated internally to an R&D budget dedicated to cement decarbonization. In Etihad’s US$600mm SLB deal in October 2020, failure to achieve its decarbonization target at the target observation date would not trigger a coupon step-up but instead an obligation to buy carbon offsets.

While we expect further innovation in the bond incentive structure and alternate pay-off mechanisms, we foresee limited investors’ appetite to accept coupon step-down in the case of successful achievement of the sustainability performance target – whereas this has been market practice in the bank market for sustainability-linked loan instruments.

Materiality, Ambition and Transparency

For investors, SLBs also provide greater visibility into the overall sustainability strategy of the issuer, and help drive diversification in labelled bonds portfolios with a broadening of the range of issuers, geographies and industries beyond the traditional, often low-yield green bond market, including sustainability-linked bond issuances from high yield issuers (e.g. EUR 500mm Public Power Corp.’s SLB, carrying a higher coupon of 50 bps if it fails to reduce its CO2 emissions by 40% by December 2022 from 2019 levels). That said, some investors have yet to participate in the SLB market, citing difficulty assessing the calibration of sustainability targets, reconciling bond impacts or other practical challenges into portfolio inclusion.

A core element of the SLB is whether the Key Performance Indicators (“KPI”) are material for the business and whether the targets are set at a level that is ambitious enough and beyond business-as-usual. To opine on such, the market relies again on a critical part of the integrity of sustainable finance: TRANSPARENCY. For the market to thrive, transparency is critical to explaining the materiality of the KPI, the targets comparability and ambition as well as context within the issuer’s strategy and broader industry.

Beyond ICMA’s guidelines on KPI materiality, there is also a lot of discussion in the market on the concept of proportionality regarding the amount raised in consideration to potential investments needed to achieve the sustainability targets as well as calibration of the potential coupon step-up in connection with the ambition level or bond pricing. Considering the still nascent state of the SLB market, those discussions are meant to and will evolve overtime as more issuances come to market and a “critical mass” is reached.

As with the “use of proceeds” bond market, the new kid on the block will gain further acceptance and earn increased credibility as a function of issuer transparency and integrity around their sustainability ambitions and progress trajectory. Despite potential challenges, the SLB can be regarded as an important signalling and financing tool in the sustainable finance toolbox, and help issuers telegraph their sustainability strategy and demonstrate related goals.

Evolving Menu of Sustainability Options

Overall, evolving investors’ expectations have contributed to product innovation and deployment of a “menu” of sustainable debt options to finance their sustainability objectives or demonstrate various ESG commitments. The acceleration in standardization in 2020 with the publications of new standards along with enforcement of regulations have enhanced the market and the volume of new issuances of sustainability-linked products is expected to continue its ascension over the coming quarters – including potentially for some sectors adopting a combined format with the traditional use of proceeds model as we’ve seen with two sustainability-linked green bonds issued in March.

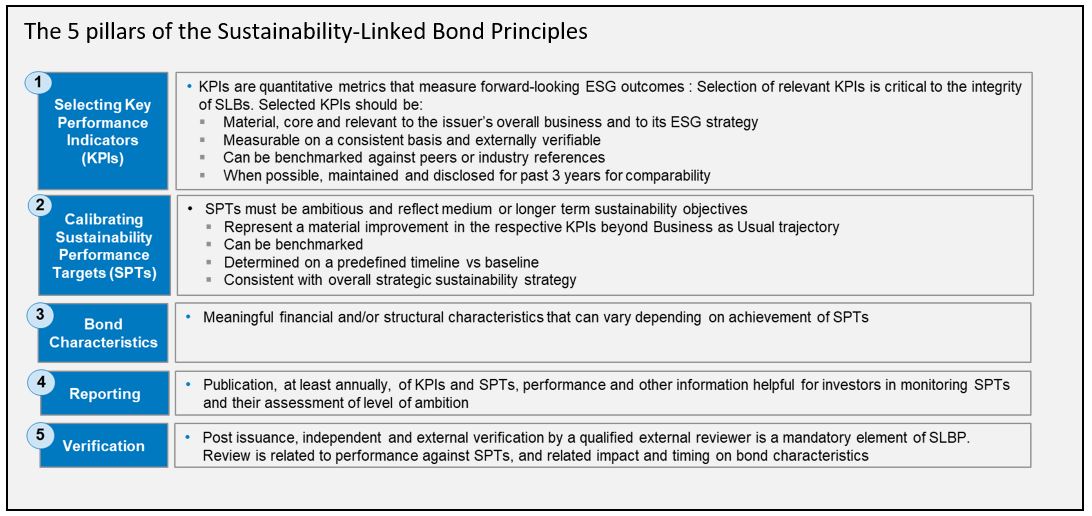

- Selectin Key Performance Indicators(KPIs)

- Calibrating Sustainability Performance Targets (SPTs)

- Bond Characteristics

- Reporting

- Verification

1 As per BNEF

2 Including European Central Bank accepting SLBs as central bank collaterals since January 2021

Innovation in Sustainability-Linked Model Fuels Booming Demand

Director, Sustainable Finance

Magali Gable joined BMO’s Sustainable Finance team in early 2020. She supports BMO’s Energy and Natural Resources clients by offering advisory services,…

Magali Gable joined BMO’s Sustainable Finance team in early 2020. She supports BMO’s Energy and Natural Resources clients by offering advisory services,…

VIEW FULL PROFILE-

Minute Read

-

Listen

Stop

-

Text Bigger | Text Smaller

Unstoppable. That’s one word that might describe the recent growth in the sustainable debt market. Driven by its most recent innovation - the so-called sustainability-linked model - the sustainable debt market now exceeds US$2.8tn of issuance across various instruments, eclipsing the US$1tn of issuance that was so trumpeted in the green bond market last year.

Addressing a Market Gap

Shortly after the publication of the Sustainability-Linked Bond (“SLB”) Principles in June 2020 (see below) by the International Capital Market Association (“ICMA”), the sustainable debt market witnessed a rocketing number of issuances of those new instruments, reaching US$35.5bn1 as of April 30, 2021 across a wide range of issuers and industries - 65 issuers over 10 industries - evidencing both strong market appetite and acceptance for this new innovative asset class2. The EMEA region has been leading the charge (as it is with sustainable debt in general), with US$24.8bn of issuances, however AMER and APAC regions are following with US$7.33bn and US$3.38bn of issuances, respectively.

The reason for innovation to turn its focus on the development of the sustainability-linked bond asset class is rooted in the need to address a market gap and potential limitations of the Green/Social and Sustainability bonds model. This incredible growth is bolstered by the desire of a broader base of issuers to signal their sustainability strategies and level of commitment to the investment community in an environment where transition taxonomies around the globe are stalling and markets have yet to arrive at a unanimously agreed upon definition of transition. As a result, the sustainability-linked bond market has mirrored the adoption success of the sustainability-linked loan, its cousin in the bank market that has itself roared from 45 issuers in 2018 to 350+ global issuers these days, with a market size of US$422.6bn1 as of April 2021.

The flexibility offered by the bond format, which does not require a dedicated ‘green’ or ‘social’ use of proceeds in the way that traditional Green, Social or Sustainability bonds do, has proven appealing to corporate bond issuers. Indeed, the SLB can be used for general corporate purposes and is meant to motivate the issuer to greater sustainability as a forward-looking instrument. As a result, while the traditional use of proceeds bonds (green/social/sustainability) were pioneered by SSAs, they are so far absent in an SLB market that is dominated by Corporates.

Built-in Incentives Demonstrate Corporate Sustainability Strategy

As an increasing number of corporates establish sustainability commitments and targets that encompass a broad range of issues (with the most popular being decarbonization at large), some have doubled down by tying those to financial outcomes built into sustainability-linked bonds.

A sustainability-linked labelled bond implies that either a financial or structural characteristic of the bond will vary depending on achieving pre-agreed Sustainability Performance Targets by a certain date within the life of the bond.

Effectively, in cases where the issuer does not achieve the set targets, most of the US$35.5bn SLBs issued in the market have an interim coupon, step-up feature built into the bond, ranging from 25 to 75bps, possibly spread across several Sustainability Performance Targets. For example, Constellium SE’s US$500mm SLB executed in February of this year will experience a 12.5 basis points coupon step-up in the event that the first sustainability performance target of 25% reduction in GHG emission intensity is not achieved by December 31, 2025, and another 12.5 basis points coupon step-up in 2026 in case of failure to achieve the second 10% increase in recycled aluminum input target. Where the company is successful achieving its targets, the bond characteristics won’t change.

Innovative alternative penalties approaches have also emerged, ultimately supporting achievement of the issuer’s sustainability strategy. In LafargeHolcim’s EUR 850mm SLB transaction executed in November 2020, for example, the 75bps potential coupon step-up could be donated to a research institute active in the fields of climate research or climate change mitigation, or reallocated internally to an R&D budget dedicated to cement decarbonization. In Etihad’s US$600mm SLB deal in October 2020, failure to achieve its decarbonization target at the target observation date would not trigger a coupon step-up but instead an obligation to buy carbon offsets.

While we expect further innovation in the bond incentive structure and alternate pay-off mechanisms, we foresee limited investors’ appetite to accept coupon step-down in the case of successful achievement of the sustainability performance target – whereas this has been market practice in the bank market for sustainability-linked loan instruments.

Materiality, Ambition and Transparency

For investors, SLBs also provide greater visibility into the overall sustainability strategy of the issuer, and help drive diversification in labelled bonds portfolios with a broadening of the range of issuers, geographies and industries beyond the traditional, often low-yield green bond market, including sustainability-linked bond issuances from high yield issuers (e.g. EUR 500mm Public Power Corp.’s SLB, carrying a higher coupon of 50 bps if it fails to reduce its CO2 emissions by 40% by December 2022 from 2019 levels). That said, some investors have yet to participate in the SLB market, citing difficulty assessing the calibration of sustainability targets, reconciling bond impacts or other practical challenges into portfolio inclusion.

A core element of the SLB is whether the Key Performance Indicators (“KPI”) are material for the business and whether the targets are set at a level that is ambitious enough and beyond business-as-usual. To opine on such, the market relies again on a critical part of the integrity of sustainable finance: TRANSPARENCY. For the market to thrive, transparency is critical to explaining the materiality of the KPI, the targets comparability and ambition as well as context within the issuer’s strategy and broader industry.

Beyond ICMA’s guidelines on KPI materiality, there is also a lot of discussion in the market on the concept of proportionality regarding the amount raised in consideration to potential investments needed to achieve the sustainability targets as well as calibration of the potential coupon step-up in connection with the ambition level or bond pricing. Considering the still nascent state of the SLB market, those discussions are meant to and will evolve overtime as more issuances come to market and a “critical mass” is reached.

As with the “use of proceeds” bond market, the new kid on the block will gain further acceptance and earn increased credibility as a function of issuer transparency and integrity around their sustainability ambitions and progress trajectory. Despite potential challenges, the SLB can be regarded as an important signalling and financing tool in the sustainable finance toolbox, and help issuers telegraph their sustainability strategy and demonstrate related goals.

Evolving Menu of Sustainability Options

Overall, evolving investors’ expectations have contributed to product innovation and deployment of a “menu” of sustainable debt options to finance their sustainability objectives or demonstrate various ESG commitments. The acceleration in standardization in 2020 with the publications of new standards along with enforcement of regulations have enhanced the market and the volume of new issuances of sustainability-linked products is expected to continue its ascension over the coming quarters – including potentially for some sectors adopting a combined format with the traditional use of proceeds model as we’ve seen with two sustainability-linked green bonds issued in March.

- Selectin Key Performance Indicators(KPIs)

- Calibrating Sustainability Performance Targets (SPTs)

- Bond Characteristics

- Reporting

- Verification

1 As per BNEF

2 Including European Central Bank accepting SLBs as central bank collaterals since January 2021

You might also be interested in

A Buyer’s Guide to Corporate Offsetting and Navigating the Voluntary Carbon Market

Why Sustainability Is Good Business: Key Takeaways from IEFA Toronto 2024

Building for Tomorrow: Real Estate, Construction, and Sustainability

A First in Western Canada: Avenue Living Leverages BMO's Retrofit Program to Add 179 New Rental Units in Downtown Edmonton

How NASA and IBM Are Using Geospatial Data and AI to Analyze Climate Risks

BMO Arranges Green Financing to Fund New Lawson Centre for Sustainability, Trinity College's Most Significant Build in a Century

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

Canada Has an Opportunity to Become a Global Leader in Carbon Dioxide Removal

BMO Climate Institute Business Leaders Survey: Nearly Half of Business Leaders in the U.S. and Canada Believe Climate Change Has Already Affected Their Businesses, but Few Have a Strategy

More Companies Have Plans to Address Climate Change Based on Rising Business Importance: Survey Results

How the Energy Sector Is Helping Canada Achieve Its Decarbonization Goals

Transforming the Global Food System to Benefit Investors and the Planet

Why Businesses Need to Accelerate Their Efforts to Fight Climate Change

BMO Donates $3 Million to GRID Alternatives to Provide Solar Energy Solutions for Low-Income Families

Banco do Brasil and BMO Financial Group to Introduce First-of-its-Kind Program to Provide Sustainability-Linked Trade Loans Supporting Brazilian Exporters

BMO Provides Innovative New Sustainability-Linked Deposit Product to Zurn Elkay Water Solutions

Quick Listen: Michael Torrance on Empowering Your Organization to Operationalize Sustainability

BMO and Bell Canada Execute Innovative Sustainability-Linked Derivative Tied to Ambitious GHG Emission Reduction Targets

BMO Named to UN-Convened Group Providing Guidance to Global Banks on Nature Target Setting

Driving Innovations In Tech To Strengthen Climate Resilience With Climate Engine’s Spatiafi, Built On Google Cloud

BMO Celebrates Earth Day with 3rd Annual Trees from Trades Day on its Global Trading Floors

BMO Donates $2 Million to the University of Saskatchewan to Accelerate Research Critical to the Future of Food

North America’s Critical Minerals Advantage: Deep Dive on Community Engagement

Exploring North America’s Critical Minerals Advantage: Global Metals, Mining & Critical Minerals Conference

Rock Legends Reflect on Mining Hits and Misses: Global Metals, Mining & Critical Minerals Conference

The Most Valuable Commodity is Trust: ICMM to BMO Global Metals, Mining & Critical Minerals Conference

BMO Experts at our 32nd Global Metals, Mining & Critical Minerals Conference

Evolving Mining for a Sustainable Energy Transition: ICMM CEO Rohitesh Dhawan in Conversation

Public Policy and the Energy Transition: Howard Learner in Conversation

Taskforce on Nature-Related Financial Disclosure (TNFD) – A Plan for Integrating Nature into Business

Takeaways from the BMO Climate Institute Small and Mid-Sized Businesses Climate Survey

BMO Ranked North America's Most Sustainable Bank by Corporate Knights for Fourth Consecutive Year

Is Green Financing for Nuclear the Next Frontier in the Energy Transition?

BMO ranked one of the most sustainable companies in North America on the Dow Jones Sustainability Indices

BMO Climate Institute Survey Shows Costs and Competing Priorities Slowing Climate Action for Small and Mid-Sized Businesses

Managing and Monetizing Your Transition to a Net Zero World with BMO and Radicle

BMO the Top Ranked Financial Institution on New Global Sustainability Benchmark Announced at COP 27

COP27 in Focus: Will Energy Security and Economic Uncertainty Impact the Climate Transition?

BMO to Invest in Innovative Carbon Offsets from CarbonCure to Permanently Store CO2

RoadMap Project: An Indigenous-led Paradigm Shift for Economic Reconciliation

A Canadian First: BMO and Concordia University Partner for a Sustainable Future with Innovative Sustainability-Linked Loan

Sustainability Strategy and Reporting for Small and Medium Sized Companies: A Discussion at the Conference of Montreal

BMO to Acquire Calgary-based Radicle Group Inc., a Leader in Environmental Services

Investment Opportunities for a Net-Zero Economy: A Conversation at the Milken Institute Global Conference

How Hope, Grit, and a Hospital Network Saved Maverix Private Capital Founder John Ruffolo

Hydrogen’s Role in the Energy Transition: Matt Fairley in Conversation

Exploring the Physical and Transition Risks Facing Food and Agriculture

Key Takeaways on Ag, Food, Fertilizer & ESG from BMO’s Farm to Market Conference

Building an ESG Business Case in the Food Sector: The Food Institute

BMO and EDC Announce Collaboration to Introduce Sustainable Finance Solutions for Canadian Businesses

Retrofitting Canada's Building Sector: Efficiency Canada’s Corey Diamond in Conversation

The Role of Hydrogen in the Energy Transition: FuelCell Energy CEO Jason Few in Conversation

BMO proud to support first Government of Canada Green Bond transaction as joint-lead manager

Op Ed: Government Action Can Help Spur More Home Building To Address Canada’s Housing Shortage

Tackling Climate Change in Metals and Mining: ICMM CEO Rohitesh Dhawan in Conversation

BMO Launches Business Within Reach: BMO for Black Entrepreneurs and Commits $100 million in loans to Help Black-led Businesses Start up, Scale up, and Grow

The Post 2020 Biodiversity Framework – A Discussion with Basile Van Havre

BMO Announces Plan to Partner with Breakthrough Energy Catalyst to Accelerate Climate Innovation

BMO Financial Group Named North America's Most Sustainable Bank for Third Consecutive Year

Mitigating the Physical Impacts of Climate Change with Spatial Finance

BMO Helps Boralex Go Beyond Renewable Energy, with the Transition of its Credit Facility to a Sustainability-Linked Loan

A Global First: BMO Supports Bruce Power with World's First Nuclear Green Financing Framework

BMO ranked one of the most sustainable companies in the world according to Dow Jones Sustainability Indices

The Future of Remote Work and Diversity in the Asset Management Industry

North American Metals & Mining first: BMO helps Sandstorm Gold Royalties achieve ESG goals with Sustainability-Linked Loan

Education, Employment and Economic Empowerment: BMO Releases Wîcihitowin ᐑᒋᐦᐃᑐᐏᐣ- First Annual Indigenous Partnerships and Progress Report

BMO Announces $12 Billion Financing Commitment towards Affordable Housing in Canada

In support of Canada’s bid to host the headquarters of the International Sustainability Standards Board

BMO supports Canada's bid to host the headquarters of the International Sustainability Standards Board

BMO Named to Canada's Best 50 Corporate Citizens Ranking by Corporate Knights

A North American First: BMO Helps Gibson Energy Fully Transition Credit Facility to a Sustainability-Linked Loan

Understanding Biodiversity Management: Best Practices and Innovation

Episode 29: What 20 Years of ESG Engagement Can Teach Us About the Future

BMO Financial Group 2020 Sustainability Report and Public Accountability Statement Now Available Online

Episode 28: Bloomberg: Enhancing ESG Disclosure through Data-Driven Solutions

BMO Ranked Among Most Sustainable Companies on Dow Jones Sustainability Index - North America

BMO investing in a sustainable future with $1M donation to the Institute for Sustainable Finance

BMO Financial Group Reaches Key Milestone in Matching 100 Per Cent of Electricity Usage with Renewables

BMO Financial Group Recognized as One of the World's Most Sustainably Managed Companies in New Wall Street Journal Ranking

Episode 23: TC Transcontinental – A Market Leader in Sustainable Packaging

BMO Financial Group to Source 100 Per Cent of Electricity Usage From Renewables

Episode 07: World Bank: Mobilizing Capital Markets for Sustainable Finance

Episode 06: Responsible Investing – Industry Trends and Best Practices from Canada